Carbon Black Market Size to Cross USD 44.77 Billion by 2034

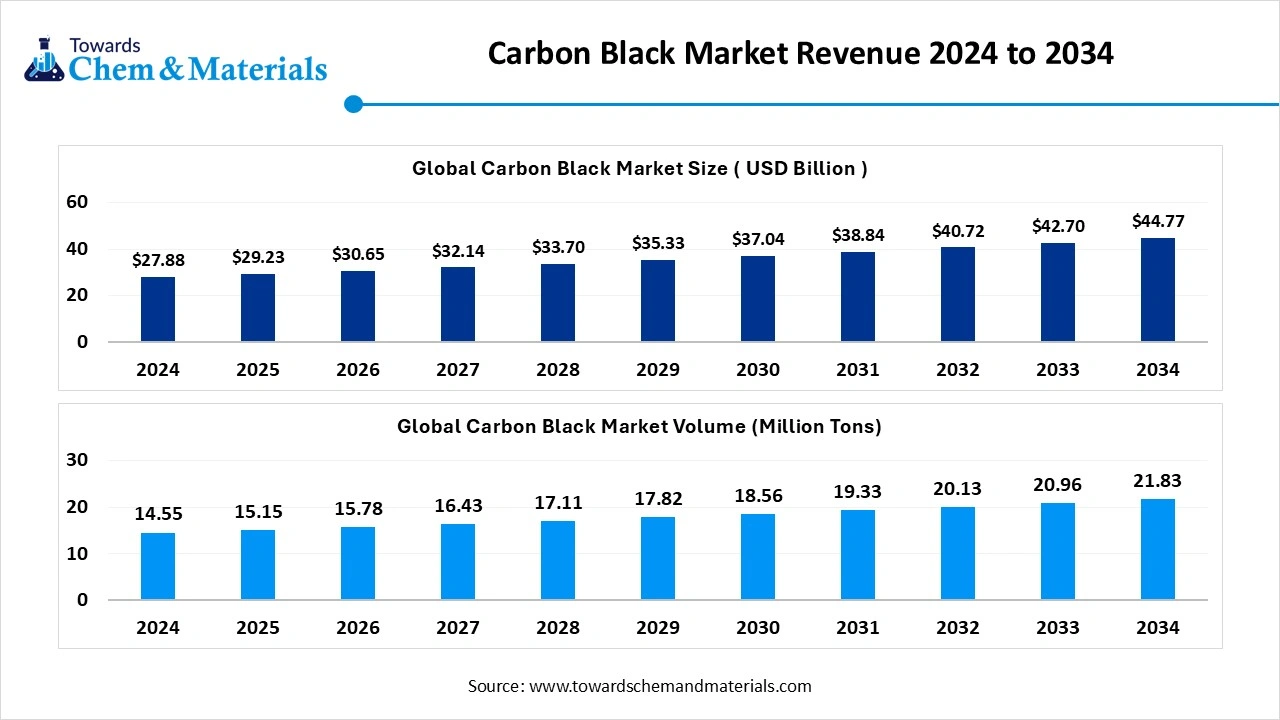

According to Towards Chemical and Materials, the global carbon black market valuation is estimated to reach USD 29.23 billion in 2025 and is anticipated to grow to USD 44.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period from 2025 to 2034.

Ottawa, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The global carbon black market size was reached at USD 27.88 billion in 2024 and is expected to be worth around USD 44.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The global carbon black market volume is roughly 15.15 million tons in 2025 and is forecast to reach 21.83 million tons by 2034 is anticipated to grow at a CAGR of 4.14% during the forecast period until 2034. Rising demand for tires and automotive products is driving the growth of the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5935

Carbon Black Overview

The global carbon black market is projected to experience steady growth, driven by its essential role in enhancing the performance and durability of various products. Carbon black a fine black powder composed primarily of carbon , produced through the incomplete combustion of hydrocarbons and is widely utilized across industries for its reinforcing, colouring, and conductive properties. The tire manufacturing sector remains the dominant application, accounting for a significant portion of carbon black consumption, as it imparts strength and wear resistance of rubber. Additionally, the plastics industry is witnessing an increasing demand for carbon black due to its ability to provide UV protection and electrical conductivity, making it valuable in the production of conductive plastics and packaging materials.

Carbon Black Market Report Highlights

- By region, Asia Pacific dominated the carbon black market with approximately 58% share in 2024.

- By product type, the furnaces' black segment dominated the market with approximately 60% industry share in 2024.

- By application type, the tires and rubber products segment dominated the market with approximately 55% industry share in 2024.

- By manufacturing process, the furnaces process segment dominated the market with approximately 60% industry share in 2024.

Carbon Black is Used In a Variety of Essential Items

- Tires: Carbon black is used to improve the processing, strength and durability important to tire manufacturing and tire performance (most notably safety), increasing tire life and fuel economy.

- Plastics: Carbon black provides color, UV protection and conductivity - power cable shielding or electrostatic dissipation - to plastics

- Batteries: Carbon black improves electrochemical conductivity and charging characteristics in lead-acid, modern stop-start, and hybrid batteries – improving overall battery efficiency.

- Pipe: Carbon black serves to protect pipes from mechanical degradation caused by harmful UV radiation.

- Wire and Cable: Carbon black extends cable life and efficiency by creating exceptionally smooth and conductive insulation, conductor shield and UV resistance.

- High Performance Coatings: Carbon black provides jetness for coatings, degradation protection from UV radiation and conductivity for coatings.

- Agricultural Irrigation, Mulch Films and Greenhouse Coverings

- Carbon black enables more efficient and better farming through water management for irrigation, retention and UV protection.

-

Toner and Printing Inks: Carbon black provides pigmentation that enhances color and undertone in various ink applications.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5935

Carbon Black Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 30.65 billion |

| Revenue forecast in 2034 | USD 44.77 billion |

| Growth rate | CAGR of 4.85% from 2025 to 2034 |

| Base year of estimation | 2024 |

| Historical data | 2001 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative Units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | Product Type Insights, Application Insights, Manufacturing Process Insights, Regional Insights |

| Key companies profiled | Tokai Carbon Co., Ltd., Continental Carbon , Jiangsu C-Chem Co., Ltd. , Himadri Specialty Chemical Ltd. , Sid Richardson Carbon & Energy Company , Raven SR, LLC , Cancarb Limited , Philips Carbon Black Limited , OCI Company Ltd. , Columbian Chemicals Company , Aditya Birla Group |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products In The Carbon Black Market

- Furnace Black – Most widely produced type; made by incomplete combustion of hydrocarbons, used in tires and rubber goods.

- Channel Black – Fine, high-structure carbon black with superior color strength; mainly used in inks and coatings.

- Thermal Black – Produced via thermal decomposition of natural gas; used in industrial rubber, insulation, and specialty applications.

- Acetylene Black – Highly conductive carbon black made from acetylene gas, essential for batteries, cables, and conductive polymers.

- Lamp Black – Oldest form, made from burning oil; used in inks, paints, and plastics for pigmentation.

- Tire Rubber Carbon Black (Reinforcing Grade) – Enhances tire strength, durability, and wear resistance; dominates market share.

- Specialty Carbon Black – Ultra-pure grades for plastics, coatings, toners, and high-end applications.

- Conductive Carbon Black – Engineered for electrical conductivity in batteries, antistatic materials, and electronics.

- Color Pigment Carbon Black – Optimized for deep black color and dispersion in inks, paints, and masterbatches.

- Recovered Carbon Black (rCB) – Sustainable alternative from recycled tires, growing rapidly in circular economy initiatives.

What Are The Major Trends In The Carbon Black Market?

- There is a growing preference for specialty carbon black grades, driven by their enhanced performance characteristics in applications such as electronics, coatings and conductive materials.

- The industry is increasingly adopting sustainable practices, including the development of eco-friendly manufacturing processes and the use of renewable feedstock’s, to meet environment regulations and consumer demand for greener products.

- Innovations in production technologies are leading to improved dispersion and reinforcement properties of carbon black, enhancing its performance in various applications.

- Emerging economies, particularly in Asia Pacific, are experiencing increased demand for carbon black due to rapid industrialization and urbanization, contributing to market expansion.

- Carbon black is finding new applications beyond traditional uses, including batteries, conductive plastics, and coatings, driven by its unique properties and the evolving needs of various industries.

How Does AI Influence The Growth Of The Carbon Black Market In 2025?

Artificial intelligence (AI) is significantly influencing the carbon black market in 2025 by enhancing manufacturing efficiency, promoting sustainability, and expanding application areas. AI driven automation and machine learning algorithms are optimizing production processes, leading to improved product consistency and reduced waste. For instance, AI powered systems enable real time monitoring and predictive maintenance, minimizing downtime and energy consumption in carbon black manufacturing plants. This technological advancement not only boosts operational efficiency but also aligns with the industry’s growing emphasis on environmental sustainability. Moreover, AI facilitates the development of innovative carbon black applications, particularly in emerging sectors such as electric vehicle (EV) batteries and conductive polymers. By analysing vast datasets, AI identifies new formulations and processing techniques that enhance the performance of carbon black in these advanced applications.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5935

Carbon Black Market Dynamics

Growth Factors

Can Specialty Carbon Black Drive New-Application Demand?

Manufacturers are increasingly turning to high performance grades of carbon black tailored for advanced uses such as conductive plastics, inks and energy storage components, which broadens the conventional rubber reinforcement role into new application territories and boosts overall demand. This shift reflects how the material’s unique electrical, UV-stabilising and conductive properties are being leveraged beyond tires and basic rubber products to meet evolving industrial and electronic requirements. Producers who offer these specialties who offer these specialty options are gaining competitive advantage by addressing the performance needs of diverse sectors. The trend also encourages innovation in formulation and processing to unlock these adjacent markets. Over time this diversification is supporting sustained growth in the carbon black market from a demand side perspective.

Is Sustainability Reshaping Carbon Black Production?

The shift toward eco-friendly manufacturing is driving demand for carbon black made from recycled and renewable feedstock. Companies are investing in cleaner processes to meet environmental goals and appeal to green focused industries. This transition is strengthening supply chains and fuelling market growth.

Market Opportunity

Can Recycled Carbon Black Create A Circular Future?

Turning end of life tires and rubber waste into recycled carbon black is opening new sustainable pathways for producers, improved pyrolysis technology is helping deliver higher quality material suitable for rubber and plastics. The shift supports circular economy goals and reduces reliance on fossil feedstock. Companies adopting rCB can meet green mandates and attract eco focused partners.

Will Advanced Plastics Boost Demand For Carbon Black?

Groining use of carbon black in high performance plastics and electronics is creating new market openings. Its properties enhance conductivity. Its properties enhance conductivity, UV protection, and colour depth in advanced materials. Manufacturers developing tailored grades are tapping into premium applications. This expansion is strengthening carbon black’s role beyond traditional rubber uses.

Limitations In The Carbon Black Market

- The high production cost of specialty carbon black is restricting adoption in many applications and regions.

- The reliance on volatile petroleum based feedstock and increasing environmental regulation create uncertainty in cost and operations for carbon black producers.

Carbon Black Market Segmentation Insights

Product Type Insights

Why Is Furnace Black Segment Dominating In Carbon Black Market?

The furnace black segment dominated the market in 2024. Furnace black has become essential due to its superior reinforcing properties in tires and rubber products, providing durability and wear resistance that are critical for automotive applications. Its widespread adoption is also driven by its versatility in plastics and coatings, where it enhances colour intensity and performance. Manufacturers continue to prioritize furnace black for large scale production because it offers consistency and reliability across multiple industrial uses. As industries evolve and expand, furnace black remains the standard choice, ensuring it maintains a strong presence in the market.

The specialty grades segment is expected to grow at the fastest rate during the forecast period. Specialty grades are increasingly valued for advanced applications such as conductive plastics, inks, and energy storage, where tailored particle size and surface chemistry improve product performance. Rising demand from electronics, batteries, and high performance materials is expanding their adoption beyond traditional rubber reinforcement.

Application Insights

Why Are Tires And Rubber Products Segment Dominating In Carbon Black Market?

The tires and rubber products segment dominated the market in 2024. Tires and rubber products remain the largest consumers of carbon black, due to the material’s ability to enhance durability, tonsils strength, and wear resistance, which are essential for automotive and industrial applications. The consistent demand from vehicle manufacturing and replacement tire markets ensures a steady need for high quality carbon black.

The battery and conductive segment is projected to expand rapidly in the coming years. The rise of electric vehicles, energy storage systems, and electronic devices is driving demand for carbon black with conductive properties. It enhances the efficiency and reliability of battery electrodes and conductive polymers, opening new-high value applications beyond traditional rubber uses.

Manufacturing Process Insights

Why Is the Furnace Process Segment Dominating In Carbon Black Market?

The furnace process segment dominated the market in 2024. The furnace process is preferred for its efficiency, scalability, and ability to produce high quality carbon black suitable for a wide range of industrial applications. It provides consistent particle size and structure, which is crucial for tires, rubber products, and specialty plastics. The established infrastructure and proven reliability make it the standard choice among manufacturers. Its dominance is reinforced by cost-effectiveness and adaptability to large scale production demands.

The specialty/ acetylene process segment in anticipated to grow with the highest rate during the studied years. This process allows production of ultra-fine and high purity carbon black, suitable for specialty applications such as conductive materials, inks, coatings, and batteries. Industries are increasingly adopting these advanced grades to meet the performance requirements of emerging technologies.

Regional Insights

Why Does Asia Pacific Region Dominated The Carbon Black Market?

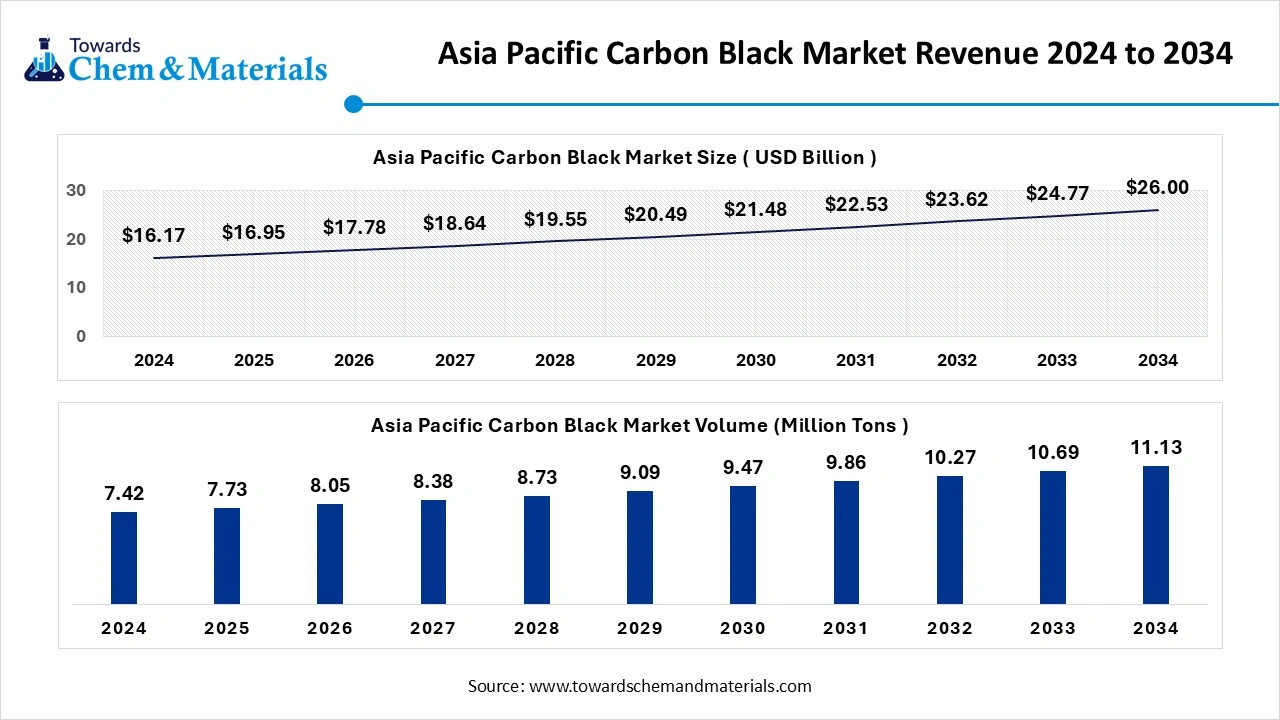

The Asia Pacific carbon black market size is valued at USD 16.95 billion in 2025 and is expected to reach USD 26.00 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034. Asia Pacific dominated the carbon black market with approximately 58% share in 2024

The Asia Pacific carbon black market stood at approximately 7.73 million tons in 2025 and is anticipated to be likely to reach approximately 11.13 million tons in 2034. growing at a CAGR of 4.16% from 2025 to 2034.

Asia Pacific dominated the market in 2024, thanks largely its thriving manufacturing base across automotive, tire, rubber, plastics and electronics industries. With countries like India and Southeast Asian economies leveraging low-cost raw materials, large labour pools and expanding export platforms, the region’s consumption and production of carbon black continue to OutSpace other areas. In addition, the presence of major tire manufacturing hubs and integrated supply chains means carbon black demand is deeply embedded in the regional industrial fabric. Investment in infrastructure, urbanisation and mobility trends further reinforce this dominance, positioning Asia Pacific as the central growth engine for carbon black.

China emerges as the primary driver within the Asia Pacific region, owning to its role as both the largest producer and consumer of carbon black globally. Its expensive tyre manufacturing sector, vast plastics and electronics output, and access to lower cost feedstock have given it a structural advantage in the carbon black supply chain.

Why Is North America The Fastest Growing Carbon Black Market?

North America is witnessing rapid growth in the carbon black market due to increasing adoption of electric vehicles and renewable energy technologies. Advanced manufacturing technologies and strong focus on sustainability are enabling producers to implement low-emission processes, improving operational efficiency. Innovation driven strategies in specialty carbon black grades are expanding applications in batteries, electronics, and high performance plastics. Regulatory support for cleaner production and green initiatives further accelerates market expansion.

The United States is emerging as a key market within North America, driven by clean manufacturing practices and sustainability initiatives. Development of renewable feedstocks and carbon recovery technologies has strengthened the industry’s growth prospects. Companies are focusing on low-carbon emission processes and advanced specialty grades to meet industrial and environmental demands.

Europe is showing notable growth in the market due to rising demand for eco-friendly and specialty grades. Regulatory frameworks like the EU Green Deal are encouraging sustainable production practices and adoption of cleaner technologies.

Germany is gaining prominence in the European carbon black market due to its strong automotive sector and leadership in green chemistry. The country is focusing on sustainable production and high-performance applications, including conductive carbon black for EV batteries, fuel cells, and smart coatings.

Carbon Black Market Top Companies

- Tokai Carbon Co., Ltd. – Global leader producing furnace and specialty carbon blacks for tires and industrial use.

- Continental Carbon – Supplies high-performance carbon black for tires, rubber, and plastics worldwide.

- Jiangsu C-Chem Co., Ltd. – Expanding Chinese producer supporting domestic and Asian tire industries.

- Himadri Specialty Chemical Ltd. – India’s integrated producer enhancing specialty and conductive carbon grades.

- Sid Richardson Carbon & Energy – Key North American supplier emphasizing quality and consistency.

- Cancarb Limited – Global leader in thermal carbon black for niche applications.

- Philips Carbon Black Ltd. – India’s largest exporter improving sustainability and efficiency.

- OCI Company Ltd. – Major Asian producer integrating chemical and carbon operations.

- Columbian Chemicals Co. (Birla Carbon) – One of the world’s largest carbon black manufacturers with advanced R&D.

- Aditya Birla Group – Parent of Birla Carbon, driving global innovation and capacity expansion.

-

Raven SR, LLC – Innovator turning waste into low-carbon feedstocks for next-generation carbon black production.

More Insights in Towards Chemical and Materials:

- Specialty Carbon Black Market : The global specialty carbon black market size accounted for USD 3.52 billion in 2025 and is forecasted to hit around USD 8.54 billion by 2034, representing a CAGR of 10.35% from 2025 to 2034.

- Specialty Polymer Market : The global specialty polymer market volume was estimated at 17.71 million tons in 2024 and is predicted to increase from 19.25 million tons in 2025 to approximately 40.7 million tons by 2034, expanding at a CAGR of 8.67% from 2025 to 2034.

- Specialty Oil Market ; The global specialty oil market size was valued at USD 15.19 billion in 2024 and is growing to approximately USD 32.34 billion by 2034, with a developing compound annual growth rate (CAGR) of 7.85% over the forecast period 2025 to 2034.

- Specialty Chemicals Market : The global specialty chemicals market size is calculated at USD 671.19 billion in 2024, grew to USD 706.36 billion in 2025, and is projected to reach around USD 1,118.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

- Specialty Fertilizers Market : The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- GCC Specialty Chemicals Market ; The global gcc specialty chemicals market size was valued at $ 36.89 billion in 2024 and is estimated to reach around USD 55.13 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.10% during the forecast period 2025 to 2034.

- U.S. Specialty Oleochemicals Market : The U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Specialty Fuel Additives Market : The global specialty fuel additives market size was estimated at USD 11.27 billion in 2024 and is predicted to increase from USD 12.07 billion in 2025 to approximately USD 22.4 billion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034.

- U.S. Specialty Chemicals Market : The U.S. specialty chemicals market size was reached at USD 192.55 billion in 2024, grew to USD 201.48 billion in 2025 and is expected to be worth around USD 303.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.64% over the forecast period 2025 to 2034.

- Carbon Disulfide Market : The global carbon disulfide market size was valued at USD 148.51 million in 2024 and is growing to approximately USD 215.64 million by 2034, with a developing compound annual growth rate (CAGR) of 3.8% over the forecast period 2025 to 2034.

- Sodium Carbonate Market : The global sodium carbonate market size was valued at USD 13.03 billion in 2024 and is expected to hit around USD 16.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.60% over the forecast period 2025 to 2034.

- Bio-based Polycarbonate Market : The global bio-based polycarbonate market size accounted for USD 80.97 million in 2025 and is forecasted to hit around USD 182.5 million by 2034, representing a CAGR of 9.45% from 2025 to 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market : The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Low-Carbon Construction Material Market : The global low-carbon construction material market size is calculated at USD 298.22 billion in 2025 and is expected to reach USD 601.63 billion by 2034, growing at a CAGR of 8.11% from 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Recycled Engineering Plastics Market : The global recycled engineering plastics market size was valued at USD 4.85 billion in 2024 and is expected to hit around USD 7.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% over the forecast period from 2025 to 2034.

Carbon Black Market Top Key Companies:

- Tokai Carbon Co., Ltd.

- Continental Carbon

- Jiangsu C-Chem Co., Ltd.

- Himadri Specialty Chemical Ltd.

- Sid Richardson Carbon & Energy Company

- Raven SR, LLC

- Cancarb Limited

- Philips Carbon Black Limited

- OCI Company Ltd.

- Columbian Chemicals Company

-

Aditya Birla Group

Recent Developments

- In October 2024, West Bengal government is actively encouraging international investment in the state’s carbon black industry, particularly in response to the growing demand for electric vehicle (EV) specialty tires and lithium-ion batteries, aiming to cater to the increasing need for these components in the rapidly expanding EV market.

- In July 2025, PCBL Chemical Limited India’s largest carbon black manufacturer, has established a wholly owned subsidiary, PCBL Chemical USA Inc., in Delaware. This strategic move aims to enhance supply chain localization and strengthen its presence in the North American market. The subsidiary will facilitate easier access to customers and help navigate the regulatory landscape in the U.S. This expansion underscores PCBL’s commitment to sustainable growth and global market integration.

Carbon Black Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Carbon Black Market

By Product Type / Grade

- Furnace Black

- Thermal Black

- Acetylene Black

- Lamp Black

- Specialty Grades

By Application

- Tires & Rubber Products

- Plastics & Polymers

- Coatings & Paints

- Inks & Toners

- Battery & Conductive Applications

- Others (Construction, Ceramics, Adhesives)

By Manufacturing Process

- Furnace Process

- Thermal Process

- Acetylene Process

- Gas Black Process

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5935

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.