Biomanufacturing Specialty Chemicals Market Size USD 26.99 Bn by 2034

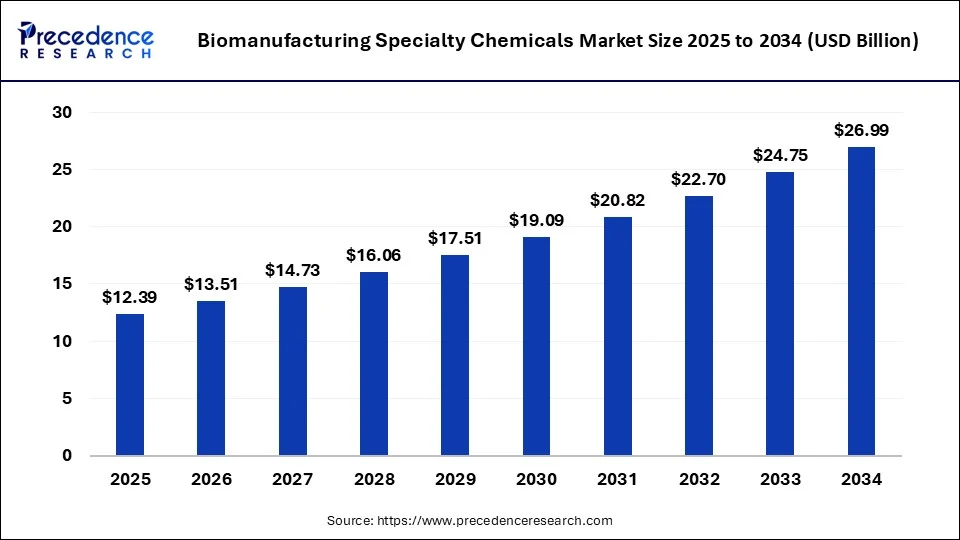

According to Precedence Research, the global biomanufacturing specialty chemicals market size will grow from USD 12.39 billion in 2025 to nearly USD 26.99 billion by 2034, with an expected CAGR of 9.04% from 2025 to 2034.

Ottawa, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The global biomanufacturing specialty chemicals market size is expected to be worth over USD 26.99 billion by 2034, increasing from USD 13.51 billion in 2026, growing at a strong CAGR of 9.04% between 2025 and 2034. Technological innovation, research and development (R&D), government support & regulatory landscape, health & wellness trends, and demand from end-use industries are driving the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/6910

Biomanufacturing Specialty Chemicals Market Key Takeaways:

-

Europe led the global market in 2024, supported by strong technological advancements, sustainability focus, and a mature chemical production base.

-

Asia Pacific is poised for the fastest growth, driven by R&D, innovation in synthetic biology, rapid industrialization, and rising demand for high-performance materials, particularly in China.

-

Industrial enzymes dominated in 2024, owing to high-quality output, increased yield, and broad industrial applications (e.g., pharmaceuticals, textiles, food processing).

-

Specialty enzymes expected to grow fastest (2025–2034), due to rising demand in precision-driven industries such as pharmaceuticals, brewing, and biofuels, with strong performance under extreme conditions.

-

Sugars & starches led in 2024, widely used for their nutritional, stabilizing, and thickening properties across food and chemical sectors.

-

Lignocellulosic biomass projected to lead growth, offering renewable, sustainable alternatives to fossil fuels and supporting carbon sequestration and land diversification goals.

-

Pharmaceuticals remained the top application segment, benefiting from targeted treatments, reduced side effects, and enhanced drug formulation capabilities.

-

Personal care & cosmetics to witness fastest growth, fueled by consumer demand for sustainable biotech ingredients with superior efficacy and safety.

-

Commercial-scale production dominated in 2024, enabling cost efficiencies and global competitiveness through economies of scale.

- Pilot-scale production set for rapid growth, playing a crucial role in validating processes and scaling innovations before full commercialization.

Market Size, Growth and Forecast

- Market Size in 2025: USD 12.39 Billion

- Market Size in 2026: USD 13.51 Billion

- Forecasted Market Size by 2034: USD 26.99 Billion

- CAGR (2025-2034): 9.04%

- Largest Market in 2024: Europe

- Fastest Growing Market: Asia Pacific

Biomanufacturing Specialty Chemicals Market Overview

What is the Biomanufacturing Specialty Chemicals Market?

The biomanufacturing specialty chemicals market refers to the production, distribution, and use of biomanufacturing specialty chemicals which are formulated to provide specific functions, improve product performance, or meet specific customer requirements. Biomanufacturing specialists play an important role in the production of gene therapies, vaccines, biologics, and other biopharmaceutical products. Biomanufacturing is to use a biological system that consists of microorganisms, enzymes, or more innovative biological cells to make pharmaceuticals, nutraceuticals, chemicals, fuels, or other value-added products from renewable resources.

Biomanufacturing benefits include lower energy usage and cost benefit the environment, as well as manufacturers and consumers. Biomanufacturing is a type of manufacturing or biotechnology that uses biological systems to produce commercially important biomaterials and biomolecules for use in medicines, food and beverages processing, and industrial applications.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

What is an Opportunity for the Biomanufacturing Specialty Chemicals Market?

Biomanufacturing specialty chemicals high use in pharmaceuticals sector will be an opportunity for the biomanufacturing specialty chemicals market. Biomanufacturing refers to the use of cells or other living organisms to produce commercially viable products. Proteins, vaccines, and monoclonal antibodies for medicinal use are all produced using biomanufacturing.

Specialty chemicals play an important role in pharmaceutical manufacturing, acting as intermediates or raw materials in the synthesis of drugs. Biomanufacturing specialty chemicals industry offers many benefits the potential for growth, higher profit margins, innovation opportunities, and market demand.

➤ Get the Full Report @ https://www.precedenceresearch.com/biomanufacturing-specialty-chemicals-market

Biomanufacturing Specialty Chemicals Market Challenges

What are the Limitations of the Biomanufacturing Specialty Chemicals Market?

Supply chain disruptions can limit the growth of the market. Supply chain disruptions may result in missed opportunities, lost sales, and a decrease in customer satisfaction. Additionally, supply chain disruptions may lead to higher shipping costs, increased production costs, and additional storage costs. Supply chain issues refer to disruptions may impede the flow of goods, services, and information between suppliers and customers. Current challenges include raw material challenges, manufacturing capacity constraints, transportation bottlenecks, labor shortages, and port congestion.

How the Specialty Chemicals Market Fuels the Growth of the Biomanufacturing Specialty Chemicals Market

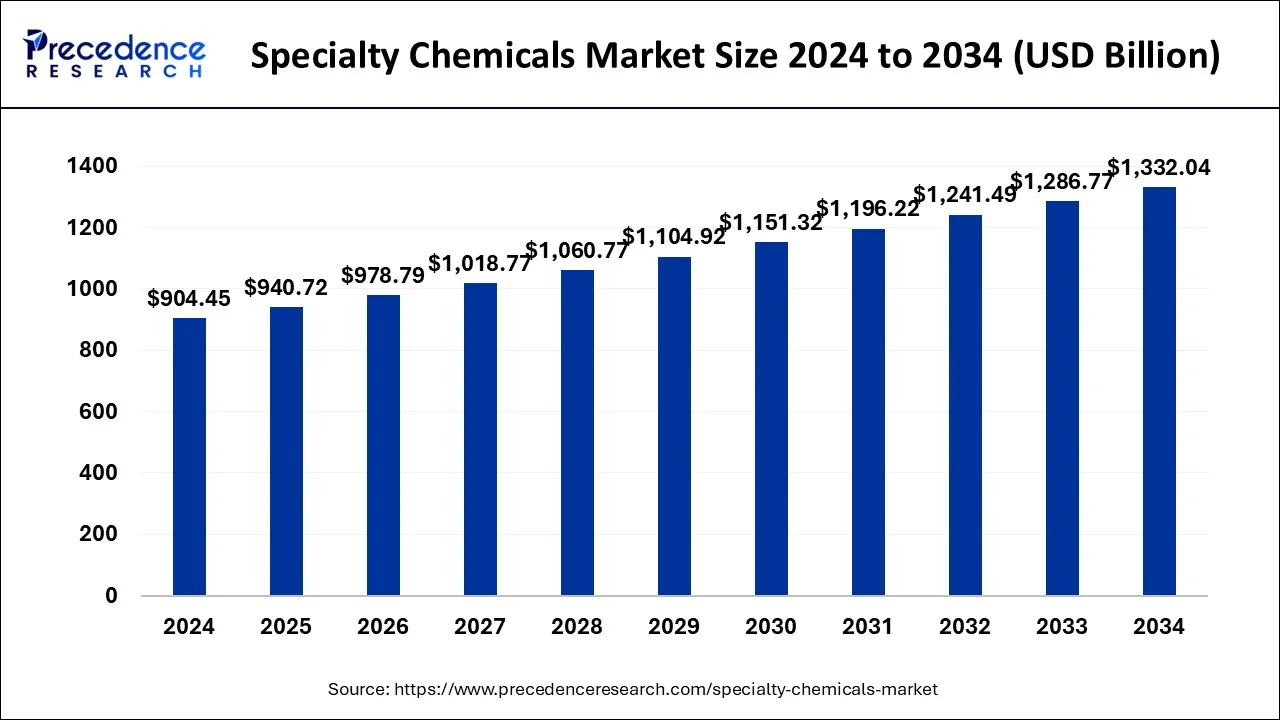

The Specialty Chemicals Market, valued at USD 904.45 billion in 2024 and projected to reach USD 1,332.04 billion by 2034 (CAGR 3.94%), is a major catalyst for the expansion of the Biomanufacturing Specialty Chemicals Market, which was valued at USD 11.36 billion in 2024 and is expected to grow to USD 26.99 billion by 2034 at a CAGR of 9.04%.

➡️ Sustainability Push: The shift toward green chemistry and renewable feedstocks in the specialty chemicals sector is driving adoption of bio-based manufacturing technologies.

➡️ Technological Convergence: Use of AI, enzyme engineering, and synthetic biology in specialty chemicals is accelerating process innovation within biomanufacturing.

➡️ High-Value Applications: Shared end-use industries—pharmaceuticals, personal care, food, and industrial materials—are boosting demand for both markets.

➡️ Collaborative Ecosystem: Partnerships among global leaders such as Evonik, BASF, DuPont, and DSM are merging chemical expertise with biomanufacturing innovation.

➡️ Regulatory Alignment: Stringent global environmental standards are promoting bio-derived specialty products with lower emissions and superior performance.

Specialty Chemicals Market Trends

- The shift toward bio-based feedstocks, biodegradable polymers, and eco-friendly formulations is accelerating, driven by regulatory mandates and consumer demand for sustainability.

- Adoption of Industry 4.0 tools as AI, IoT, digital twins, and predictive maintenance, is enhancing efficiency and enabling flexible, high-precision production.

- Industries increasingly demand specialty additives and materials such as specialty polymers and adhesives with anti-microbial, self-healing, or lightweight properties tailored to specific application needs.

- Companies are moving toward nearshoring and diversifying supplier networks to reduce disruptions and improve logistics transparency.

- Demand is surging for green solutions, such as recycled plastics, safe-by-design chemistries, and enzymatic or catalytic processes that lower environmental impact.

- Bioanalysis and nanotechnology are enabling new material functionalities and greener production processes, especially for fine and specialty chemicals.

Specialty Chemicals Market Key Players

- BASF SE

- Bayer AG

- Dow, Inc.

- Lanxess AG

- Evonik Industries AG

- Clariant AG

- Solvay SA

- Albemarle Corporation

- Huntsman International LLC

- Sumitomo Chemical Company

- Nouryon

- Ashland LLC.

- Merck & Co., Inc.

- Henkel Ag & Co. KGAA

- Sasol Limited

- 3M

- PPG Industries Inc.

- Koninklijke DSM N.V.

- B. Fuller

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1037

Biomanufacturing Specialty Chemicals Market Report Coverage

| Report Attributes | Key Statistics |

| CAGR 2025 to 2034 | 9.04% |

| Market Size in 2025 | USD 12.39 Billion |

| Market Size in 2026 | USD 13.51 Billion |

| Market Size by 2034 | USD 26.99 Billion |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Feedstock, Application, Scale of Production, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Case Study: Sustainable Biomanufacturing Transformation through Enzyme Innovation – The Evonik-DuPont Collaboration Model

Overview

This case study illustrates how technological innovation and strategic collaboration in biomanufacturing specialty chemicals are enabling global chemical leaders to transition from fossil-based to bio-based production while improving cost efficiency, scalability, and sustainability. It focuses on Evonik Industries and DuPont—two key players mentioned in the Biomanufacturing Specialty Chemicals Market—who jointly developed enzyme-based process technologies for bio-based monomer and polymer production.

Challenge: Reducing Carbon Dependency in Specialty Chemical Production

Traditional specialty chemical production depends heavily on petrochemical feedstocks, which present environmental, cost, and regulatory risks. Both Evonik and DuPont faced increasing regulatory pressure under the EU’s Green Deal and Bioeconomy Strategy to decarbonize operations. Their shared challenge was to reduce lifecycle carbon emissions, eliminate hazardous intermediates, and maintain cost competitiveness while meeting growing industrial demand for high-performance materials.

Additionally, market volatility due to supply chain disruptions and raw material price instability created further pressure to localize sustainable feedstock sources and optimize process efficiency.

Strategy: Integrating Biomanufacturing through Synthetic Biology and Enzymatic Catalysis

Evonik and DuPont launched a collaborative R&D initiative in 2023 aimed at replacing fossil-derived intermediates with bio-based alternatives through enzymatic and fermentation-driven production. Their approach integrated three critical strategies aligned with the trends outlined in the Biomanufacturing Specialty Chemicals Market Report:

- Feedstock Diversification: Transitioned from petrochemical to lignocellulosic biomass and waste glycerol as carbon sources, aligning with Europe’s sustainability mandates.

- Enzyme Engineering: Developed custom enzyme catalysts to improve yields and selectivity in biopolymer precursor synthesis. These included thermostable specialty enzymes capable of maintaining activity under industrial process conditions.

-

Digital Bioprocess Optimization: Adopted AI-driven strain optimization and digital twin modeling (similar to SyntecBiofuel’s AI-based biomanufacturing platform announced in 2025) to simulate production parameters and reduce time-to-scale.

Implementation: Pilot-to-Commercial Transition

Evonik’s Marl Chemical Park in Germany served as the pilot site, producing polyamide intermediates and biosurfactants using enzymatic routes. Once process stability and scalability were validated, DuPont integrated the model into its industrial biotechnology unit in the U.S. for global supply deployment.

Key stages of implementation:

- Pilot Phase (2023–2024): Process validation at 1/100th commercial scale; yield improvement of 35% and cost reduction of 18%.

- Scale-up Phase (2025): Commercial deployment for biosurfactants and bio-based polymers at 20,000 tons per year.

-

Commercial Operation (2026 onward): Global licensing of the enzyme platform to contract manufacturing organizations (CMOs) and specialty chemical producers across Europe and Asia.

Outcomes and Measurable Impact

- Carbon Reduction: Achieved a 42% reduction in lifecycle GHG emissions compared to petrochemical equivalents.

- Economic Efficiency: Reduced production costs by up to 20% through optimized enzyme usage and lower energy requirements.

- Scalability: Shortened pilot-to-commercial transition time by 30% using digital twin simulations and continuous fermentation systems.

- Market Penetration: Captured early adoption in pharmaceuticals, personal care, and industrial chemicals—mirroring the leading and fastest-growing segments identified in the Precedence Research report.

-

Regulatory Compliance: Fully aligned with EU REACH and U.S. EPA bio-based product certifications, positioning both companies as benchmarks for low-carbon specialty chemical manufacturing.

Lessons Learned

- Technology Integration Matters: Successful biomanufacturing depends not only on biological innovation but also on process digitalization and cross-industry data sharing.

- Feedstock Sustainability Is Strategic: Moving from first-generation sugars to lignocellulosic and waste-based inputs supports both cost competitiveness and environmental goals.

-

Collaborative Models Drive Scale: Partnerships between established manufacturers and bio-innovation specialists enable faster commercialization and global adoption.

Broader Industry Implication

This case validates how biomanufacturing specialty chemicals can accelerate the shift toward a circular bioeconomy. It demonstrates that enzyme innovation, AI-driven optimization, and sustainable feedstock utilization collectively form a viable blueprint for industrial transformation.

The Evonik-DuPont collaboration underscores the same market dynamics identified in the Biomanufacturing Specialty Chemicals Market Report—namely, the rise of industrial enzymes, pilot-scale validation, and commercial-scale cost efficiency as critical success levers in the 2025–2034 forecast period.

Conclusion

The Evonik-DuPont biomanufacturing model provides a replicable framework for other players in the specialty chemicals ecosystem—particularly startups and SMEs—to leverage enzyme innovation, digital bioprocessing, and renewable feedstocks. This aligns with Precedence Research’s observation that Europe will remain a dominant production hub, while Asia Pacific emerges as the fastest-growing innovation frontier through synthetic biology and advanced fermentation systems.

By demonstrating measurable sustainability, economic viability, and scalability, this case exemplifies how the biomanufacturing specialty chemicals industry can redefine industrial chemistry in the post-petroleum era.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/6910

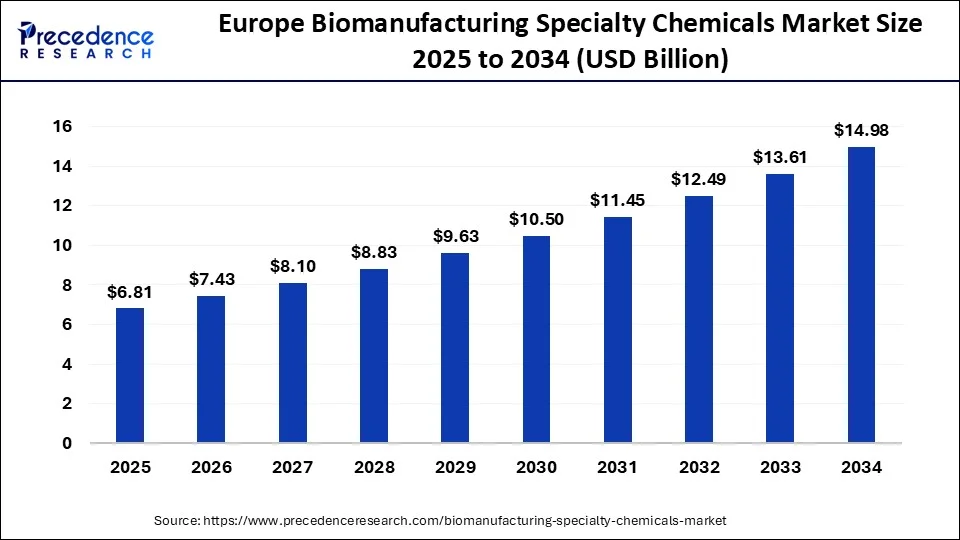

What is the Europe Biomanufacturing Specialty Chemicals Market Size?

According to Precedence Research, the global the Europe biomanufacturing specialty chemicals market size is calculated at USD 6.81 billion in 2025 and is projected to reach approximately USD 14.98 billion by 2034, with an expected CAGR of 9.13% from 2025 to 2034.

Europe dominated the global biomanufacturing specialty chemicals market in 2024 due to the technological advancements, high-value niche markets, consumer and industry demand, and sustainability & environmental concerns, sustainable feedstock, government initiatives, and growing environmental consciousness in the region. Europe is the second largest chemicals producer in the world.

Top Countries’ Analysis in Europe Biomanufacturing Specialty Chemicals Market:

As the second-largest chemicals producer globally, the region benefits from well-established clusters of chemical manufacturers, advanced fermentation technologies, and a focus on high-value, niche applications such as specialty enzymes, bio-based polymers, and pharmaceuticals. Government policies across the EU, such as the European Green Deal and Bioeconomy Strategy, are catalyzing the transition toward circular and low-carbon manufacturing. Moreover, growing environmental consciousness among consumers and industries is accelerating demand for bio-based alternatives. With countries like Germany, France, and the Netherlands leading in R&D, Europe is positioned not just as a production hub but as a global benchmark for responsible and innovation-driven biomanufacturing.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period because of the innovation, R&D, demand for high performance materials, expanding middle class, rapid industrialization & infrastructure development, improvements in catalytic processes, and innovation in synthetic biology in the region. The market for specialty chemicals growing robustly, especially with the China adopted by global players.

Biomanufacturing Specialty Chemicals Market Segmentation Analysis

Product Type Analysis

The industrial enzymes segment held a dominant presence in the market in 2024. Industrial enzymes benefits include it allows the manufacturing of high-quality products, increasing the yields, and avoiding unwanted by-products. Enzymes which are used in industrial processes, include leather processing, textiles, pharmaceuticals, fermented products, detergents, brewing, and baking. Industrial enzymes are generally produced under carefully controlled conditions by fermentation using microorganisms, especially bacteria or fungi. The special properties of industrial enzymes include thermotolerance, tolerance to a wide range of pH, and stability of enzymes activity over a harsh reaction condition.

The specialty enzymes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Specialty enzymes are used in research and industrial purpose. They increase the rate of chemical reactions without themselves being consumed or permanently altered by the reaction. They increase reaction rates without altering the chemical equilibrium between reactants and products. Industrial applications of specialty enzymes include proteases, amylases, and celluloses are most commonly used in textile, paper, brewing, and food industry.

Feedstock Analysis

The sugars & starch segment accounted for a considerable share of the market in 2024. Sugars and starches are important food nutrients. Our body turns carbs into glucose to give the energy we need to function. Research shows that adding more resistant starch to the diet can promote improved gut health. Food starches are generally used as stabilizers and thickeners in foods like salad dressings, pie fillings, gravies, sauces, soups, custards, and puddings, as well as in the production of past and noodles.

The lignocellulosic biomass segment is projected to experience the highest growth rate in the market between 2025 and 2034. Lignocellulosic biomass is one of the most important renewable materials to replace carbon-based fossil resources. Solvent-based fractionation is a promising route for fractionation of biomass into its major components. A significant benefit of lignocellulosic biomass (LCB) production is the restoration of habitats, the sequestration of carbon, and the diversification of land use.

Application Analysis

The pharmaceuticals segment led the market. The use of biomanufacturing specialty chemicals in pharmaceuticals benefits include lower the risk of side effects. They do this by selectively targeting disease-causing molecules or pathways. Biologic medicines treat autoimmune diseases such as rheumatoid arthritis and psoriasis. They can regulate the immune response without entirely suppressing it. The uses of chemicals in pharmaceuticals include improving dosing & formulations, managing drug interactions, understanding drug mechanisms, medical device coatings, and more.

The personal care & cosmetics segment is set to experience the fastest rate of market growth from 2025 to 2034. Biotech based ingredients can exhibit superior efficacy as compared to traditional alternatives. Chemicals in personal care and makeup products have many uses, from preserving the product and adding fragrance, to providing sun protection and adding fragrance, to providing sun protection and making the product feel silky and smooth.

Scale of Production Analysis

The commercial-scale production segment registered its dominance over the market in 2024. Commercial-scale production means the scale of chemical or biological process for the manufacture of a product in sufficient quantities to support the projected supply needs for the marketed product as of first commercial scale of such product. These industries benefit from reduced costs per unit as production volume increases, making operations more financially efficient and competitive on a global scale.

The pilot scale production segment is anticipated to grow with the highest CAGR in the market during the studied years. Pilot scale production is the beginning of the end of product development. It is the part of contract manufacturing services and is used at the end of engineering development during new product introduction to validate processes, methods, and systems under quality controls. Pilot scale production ensures relatively large quantities than laboratory scale.

End User Analysis

The specialty chemicals manufacturers segment dominated the market. The benefits of specialty chemicals include catalysts, improved performance, tailored formulations, and precision & performance. Specialty chemicals products include photographic chemicals, flavors & fragrances, adhesives, explosives, paints, dyestuffs, unrecorded media and many industrial specialties. They help in enhancing energy efficiency, reducing environmental impact, and ensuring compliance with environmental regulations.

The startups & SMEs segment is projected to expand rapidly in the market in the coming years. Many departments and ministries have introduced schemes to provide infrastructural, financial, and regulatory support to startups. Startup scheme benefits also include exemption of capital gains tax under special conditions, exemption of income tax for three straight years, and rebate in the fee for feeling the patent application. Small and medium enterprises (SMEs) exhibit agility, easily adapting to changing market conditions and contributing to overall business resilience.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Competitive Landscape in the Biomanufacturing Specialty Chemicals Market:

| Company | Major Offerings |

| Novonesis | Enzyme solutions, biosolutions for food, agriculture, and industrial applications |

| International Flavors & Fragrances (IFF) | Specialty enzymes, cultures, and ingredients for nutrition, health, and fragrance segments |

| Evonik Industries | Specialty additives, amino acids, biosurfactants, and industrial biotechnology solutions |

| DuPont | Industrial enzymes, biomaterials, specialty proteins, and advanced nutrition components |

| Corbion | Lactic acid derivatives, emulsifiers, biopolymers, and fermentation-based food and pharma ingredients |

| BASF SE | Enzymes, biopolymers, biosurfactants, and specialty chemicals for pharma, agriculture, and cosmetics |

| DSM | Nutritional ingredients, specialty enzymes, bio-based chemical innovations |

| Mitsubishi Chemical Corporation | Bioplastics, bio-based chemicals, industrial enzymes |

| GF Biochemicals Ltd. | Bio-based levulinic acid and derivatives used in solvents, fuels, and plasticizers |

| Cargill, Incorporated | Bioindustrial solutions, fermentation-based chemicals, food-grade and pharma-grade bioingredients |

| Toray Industries, Inc. | Biopolymers, bio-based synthetic fibers, and enzyme-related materials |

| ADM (Archer Daniels Midland) | Enzymes, bio-based feedstock chemicals, fermentation-based ingredients for food and pharma |

| TOTAL | Biofuels, bioplastics, and renewable chemical solutions (via Total Corbion joint ventures) |

| AGAE Technologies, LLC | Biosurfactants (especially rhamnolipids) for industrial and environmental applications |

| Vertec BioSolvents, Inc. | Bio-based solvents for coatings, cleaning, and industrial chemical applications |

Recent Developments

- In September 2025, the Tata Chemicals Limited (TCL)-TERI Centre of Excellence to advance India’s bioeconomy was launched by Nitin Desai, Chairman, TERI; R. Mukundan, Managing Director and CEO, Tata Chemicals Limited; and Dr. Vibha Dhawan, Director General, TERI. This center aims to develop innovative, cost-effective technologies for platform and specialty biochemicals derived from renewable first- and second-generation feedstocks. (Source: https://chemindigest.com)

- In July 2025, the launch of AI-based biomanufacturing platform, a comprehensive digital-physical system designed to accelerate the development of scale-up of low-carbon biofuels was announced by SyntecBiofuel, a leader in next-generation bioenergy solutions. This platform includes seamless scale-up pathway, digital twin simulation, automated bioreactor control, and machine learning driven strain optimization. (Source: https://www.barchart.com)

Segments Covered in the Report

By Product Type

- Enzymes

- Industrial Enzymes (detergents, textiles, pulp & paper)

- Food Enzymes (bakery, dairy, brewing)

- Pharmaceutical Enzymes (therapeutic, diagnostic)

- Specialty Enzymes (research, niche industrial use)

- Amino Acids

- Essential Amino Acids (lysine, methionine, threonine, tryptophan)

- Non-Essential Amino Acids (glutamine, glycine, alanine)

- Specialty Amino Acids (D-amino acids, cysteine derivatives)

- Organic Acids

- Citric Acid

- Lactic Acid

- Succinic Acid

- Itaconic Acid

- Other Niche Acids (gluconic, fumaric, malic)

- Biopolymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Polymers

- Other Specialty Biopolymers (chitosan, alginate derivatives)

- Biosurfactants

- Rhamnolipids

- Sophorolipids

- Mannosylerythritol Lipids (MELs)

- Other Emerging Biosurfactants

- Bio-Solvents

- Ethanol

- Butanol

- Acetone

- Glycerol Derivatives

- Others

By Feedstock

- Sugars & Starch

- Lignocellulosic Biomass

- Algae

- Glycerol

- Waste Streams

By Application

- Pharmaceuticals

- Food & Beverages

- Agriculture

- Personal Care & Cosmetics

- Industrial Chemicals

- Textiles

- Environmental Applications

By Scale of Production

- Laboratory Scale

- Pilot Scale

- Commercial Scale

By End User

- Specialty Chemical Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Research Institutes

- Startups & SMEs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/6910

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Chemical Distribution Market: Explore how evolving supply chains and digital platforms are reshaping global chemical trade and logistics.

➡️ Specialty Oilfield Chemicals Market: Examine how advanced formulations are enhancing oil recovery efficiency and environmental performance.

➡️ Specialty Pesticides Market: Learn how precision agriculture and eco-friendly pest control solutions are driving next-generation pesticide demand.

➡️ Specialty Oleochemicals Market: Understand how plant-based feedstocks are powering the shift toward sustainable chemical manufacturing.

➡️ Recombinant Chemicals Market: Discover how biotechnological innovations are redefining the production of high-value recombinant compounds.

➡️ Basic Chemicals Market: See how industrial recovery and circular economy initiatives are influencing core chemical demand.

➡️ Specialty Polymer Market: Track how high-performance materials are transforming electronics, automotive, and medical applications.

➡️ Fermentation Chemicals Market: Explore how bio-based fermentation is replacing petrochemical routes across diverse industries.

➡️ Cosmetic Chemicals Market: Analyze how clean beauty, sustainability, and biotech-driven actives are redefining personal care formulations.

➡️ Generative AI in Chemical Market: Discover how AI-driven molecular design is accelerating innovation across the global chemical landscape.

➡️ Active Pharmaceutical Ingredients CDMO Market: Understand how outsourcing and biologics manufacturing are transforming the global API ecosystem.

➡️ Synthetic Biology for Industrial Enzymes Market: Learn how synthetic biology is enabling enzyme optimization for industrial and biomanufacturing applications.

➡️ Specialty Resins Market: Explore how innovation in lightweight composites and coatings is driving demand for specialty resins.

➡️ Crop Protection Chemicals Market: See how integrated pest management and bio-based alternatives are shaping modern agriculture.

➡️ Enzyme Engineering Market: Analyze how enzyme customization and computational design are fueling breakthroughs in sustainable chemistry.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.