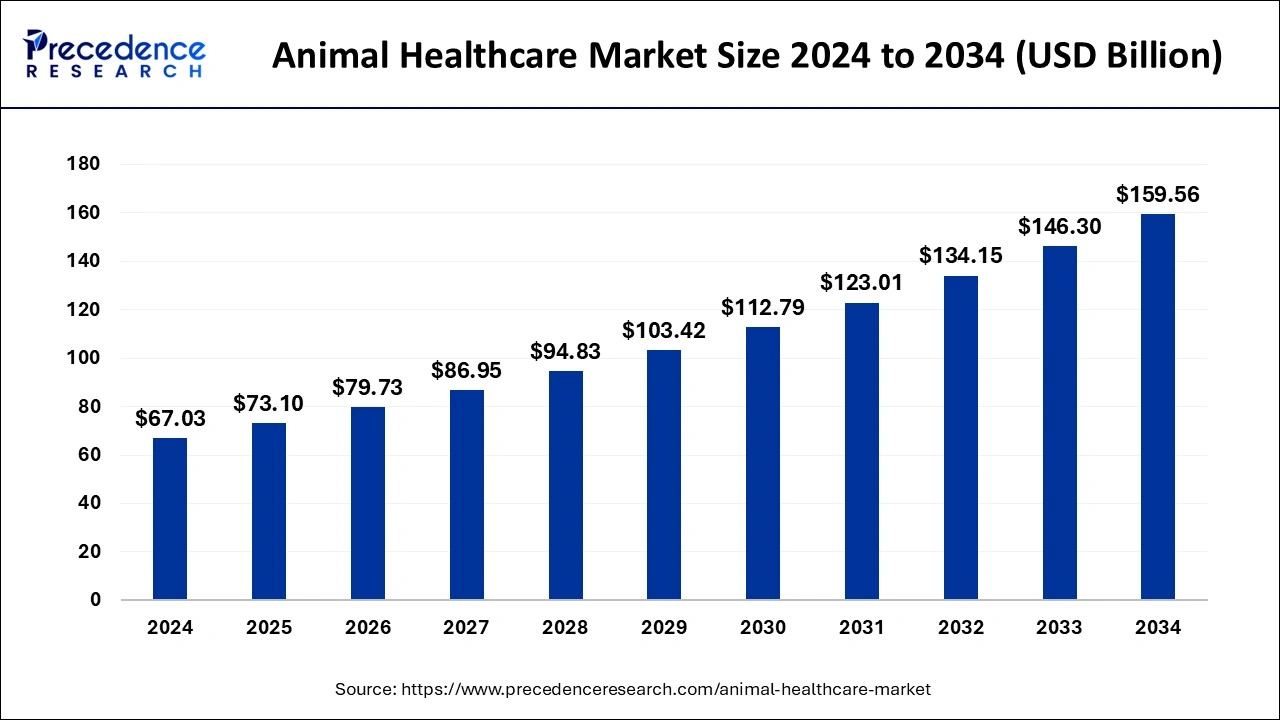

Animal Healthcare Market Size Worth USD 159.56 Billion by 2034

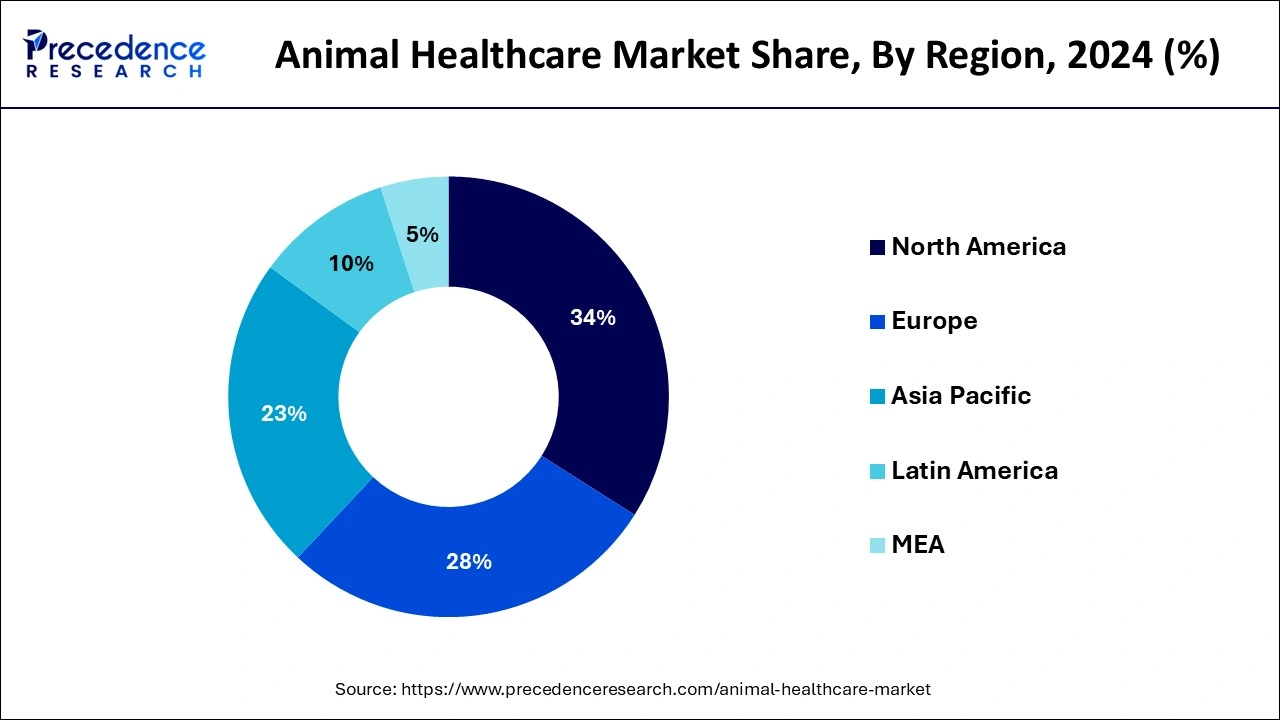

According to Precedence Research, the global animal healthcare market size will grow from USD 73.10 billion in 2025 to nearly USD 159.56 billion by 2034, with an expected CAGR of 9.06% from 2025 to 2034. North America dominated the market with a 34% share in 2024, while Asia Pacific is projected to grow at a double-digit CAGR of 12.4% during the forecast period.

Ottawa, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The global animal healthcare market size is expected to be worth over USD 159.56 billion by 2034, increasing from USD 73.10 billion in 2025, growing at a strong CAGR of 9.06% between 2025 and 2034. The growing pet ownerships and increasing awareness about animal health drives the overall market growth.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1621

Animal Healthcare Market Highlights:

- North America dominated the market with a 34% share in 2024.

- Asia Pacific is projected to grow at a double-digit CAGR of 12.4% during the forecast period.

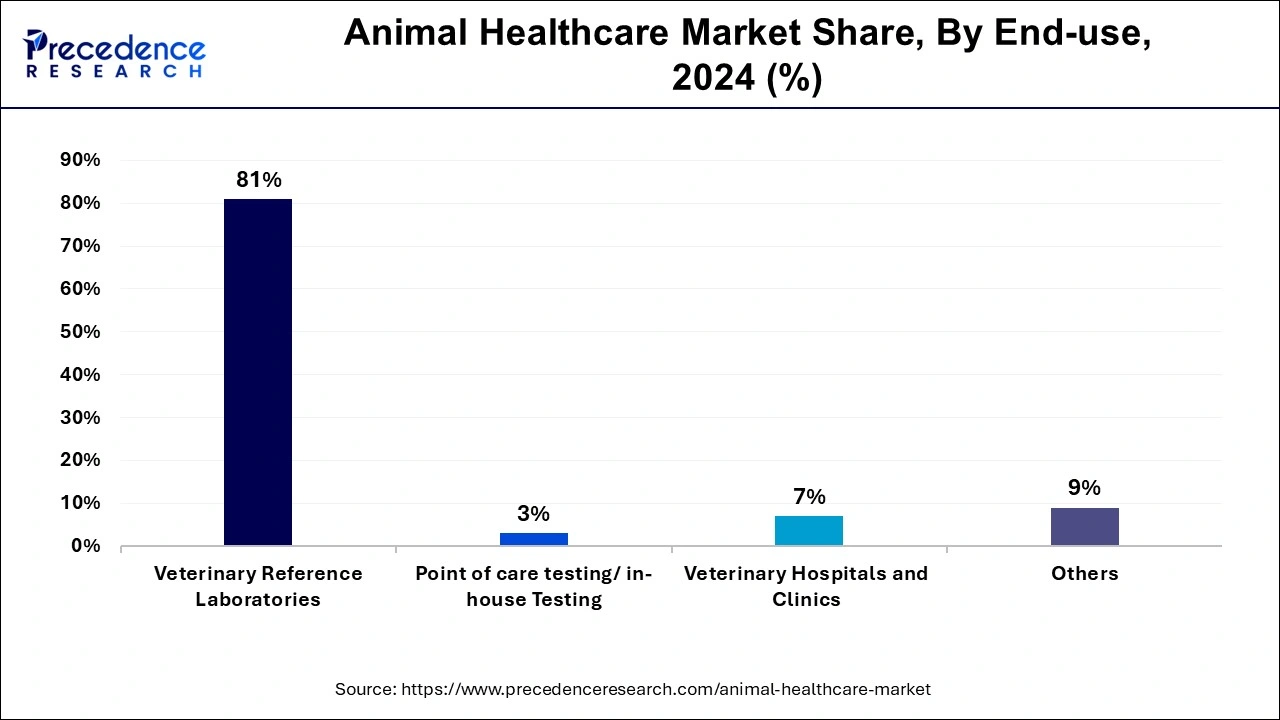

- By end-use, the veterinary reference laboratories segment accounted for the largest 81% share in 2024.

- The point-of-care testing/in-house testing segment is expected to record solid growth during the forecast period.

- By distribution channel, the hospital/clinic pharmacy segment generated the highest share in 2024.

- By animal type, the production animal segment led the global market in 2024.

- By product, the pharmaceutical segment dominated with a 44% share in 2024.

Market Size and Forecast 2025 to 2034

- Market Size in 2025: USD 73.10 Billion

- Market Size in 2026: USD 79.73 Billion

- Forecasted Market Size by 2034: USD 159.56 Billion

- CAGR (2025-2034): 9.06%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Animal Healthcare?

The animal healthcare market growth is driven by the growing zoonotic diseases, increasing animal health maintenance, strong focus on disease prevention, and the rising number of pet owners. Animal healthcare is the treatment, prevention, & diagnosis of injuries & diseases in animals.

Animal healthcare focuses on medical treatment, food safety, preventive care, and animal care. It offers specialized care across various animal species like livestock, animals, pets, and wildlife. Animal healthcare includes veterinarians, animal physiotherapists, nurses, and veterinary technicians.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Major Government Initiatives for Animal Healthcare:

-

Livestock Health and Disease Control Programme (LHDCP): This centrally sponsored scheme aims to control and eradicate major animal diseases, such as Foot-and-Mouth Disease (FMD) and Brucellosis. It strengthens veterinary services and infrastructure through vaccination drives, disease surveillance, and deploying Mobile Veterinary Units to provide doorstep care.

-

Rashtriya Gokul Mission (RGM): The RGM focuses on the conservation and development of indigenous bovine breeds to enhance their productivity. It includes promoting high-quality breeding practices, establishing Integrated Indigenous Cattle Centres, and strengthening veterinary facilities for breed management.

-

Animal Husbandry Infrastructure Development Fund (AHIDF): A central sector scheme, the AHIDF provides financial incentives to private investors, MSMEs, and FPOs for establishing infrastructure like animal feed plants and facilities for producing veterinary medicine and vaccines. This initiative aims to increase processing capacity, ensure quality products, and boost exports.

-

National Livestock Mission (NLM): The NLM promotes sustainable livestock development with an emphasis on employment generation and entrepreneurship. It focuses on breed improvement, feed and fodder development, and providing risk management through livestock insurance.

-

Animal Quarantine and Certification Services (AQCS): The AQCS operates animal quarantine stations to prevent the spread of exotic livestock diseases into India. This service enforces rigorous quarantine protocols and certifies the health of imported and exported livestock and their products.

What are the Key Trends of the Animal Healthcare Market?

-

Digital Transformation in Animal Healthcare: AI, telehealth, and other digital solutions are reshaping veterinary medicine by providing tools for remote monitoring, faster diagnostics, and predictive analytics. This shift improves care efficiency, expands access to veterinary services, especially in rural areas, and enhances overall animal welfare.

-

Rising Adoption of Pet Humanization and Premium Care: The growing trend of treating pets as family members has led to a significant increase in spending on advanced veterinary treatments, wellness products, and diagnostics. This drives demand for specialized pet-centric services like oncology, dentistry, and customized nutrition plans, boosting the companion animal healthcare market.

-

Increased Focus on Preventive Care and Nutrition: There is a rising emphasis on proactive health management, including regular check-ups, vaccinations, and specialized nutrition, to prevent diseases before they become severe. This approach not only improves animals' long-term health and quality of life but also offers cost savings by reducing the need for expensive treatments.

-

Expansion of the 'One Health' Approach: With increased awareness of zoonotic diseases spreading between animals and humans, there is a growing focus on the interconnectedness of human, animal, and environmental health. This integrated strategy promotes collaboration across sectors to enhance disease surveillance, manage outbreaks, and reduce the risk of transmission.

-

Advancements in Diagnostics and Therapeutics: Technological innovation is rapidly advancing veterinary diagnostics and therapeutics with the development of sophisticated tools like molecular diagnostics, advanced imaging, and antibody-based treatments. These innovations lead to more precise and effective disease detection and treatment, improving clinical outcomes for a variety of animal species.

➤ Get the Full Report @ https://www.precedenceresearch.com/animal-healthcare-market

Animal Healthcare Market Opportunity

Growing Pet Ownership

The growing rate of pet ownership and focus on ensuring pets live longer increase demand for animal healthcare services. The strong focus on pet humanization and routine check-ups increases adoption of animal healthcare services. The presence of a wide variety of veterinary services, like wellness products, surgeries, and vaccines, helps in treating diseases of animals.

The strong focus on preventive animal care and the growing prevalence of various diseases in animals increase the adoption of animal healthcare services. The strong focus on personalised nutrition of animals and the rise in pet insurance increase demand for animal healthcare. The growing pet ownership creates an opportunity for the growth of the market.

Animal Healthcare Market Limitations and Challenges

High Cost

With several benefits of animal healthcare in preventing animal diseases, the high cost of care restricts the market growth. Factors like need for specialized training, lack of insurance, high standards of care, advanced medical technology, and high fees for veterinary consultations are responsible for the high cost of care.

The high cost of procedures, drugs, and vaccines directly affects the market. The need for intensive training and advanced tools like surgical equipment, X-rays, & MRIs increases the cost. The need for advanced treatments and the high cost of pharmaceuticals increase the cost. The high cost of care hampers the growth of the market.

Animal Healthcare Market Scope

| Report Coverage | Details | |

| Market Size in 2024 | USD 67.03 Billion | |

| Market Size in 2025 | USD 73.10 Billion | |

| Market Size in 2026 | USD 79.73 Billion | |

| Market Size by 2034 | USD 159.56 Billion | |

| CAGR from 2025 to 2034 | 9.06% | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | Animal Type, Product, Distribution Channel, End Use, Treatments, and Region | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Set up a meeting at your convenience to get more insights instantly! https://www.precedenceresearch.com/schedule-meeting

Case Study: APAC POC Diagnostics + Tele-Vet Rollout That Shifted Growth Drivers

Compress diagnostic turnaround time (TAT), lift preventive care uptake, and expand pharmacy revenue in fast-growing Asia Pacific.

Setting

Multi-city veterinary network (85 clinics; 6 Tier-1 labs) serving companion and production animals. Baseline: 48–72h lab TAT; low wellness plan adoption; fragmented pharmacy sales.

Intervention (12 months)

- Deploy point-of-care (POC) hematology/biochemistry/immunoassay analyzers to 70 clinics.

- Integrate cloud LIMS with tele-vet triage and e-Rx to hospital/clinic pharmacies.

- Launch production-animal health packages: vaccination, deworming, mastitis early-detect, and feed additive adherence tracking.

- Introduce pet wellness plans bundled with diagnostics (annual CBC/CMP/thyroid, parasitic screens) and remote follow-ups.

- Train staff on antimicrobial stewardship protocols; gate certain antibiotics behind culture/sensitivity results.

Execution

Phased rollout (pilot 10 sites → scale 60 sites → optimize 15 sites). KPI dashboards updated daily (TAT, case mix, Rx capture, re-visit rate, antibiotic DDD/1,000 patient-days).

Outcomes (Month 12 vs Baseline)

- TAT: 48–72h → 15–20 min (POC) for 62% of test volume; reference labs reserved for complex panels.

- Case conversion: Diagnostic-led consults +28%; wellness plan attachment from 9% → 31%.

- Revenue mix: Hospital/clinic pharmacy share +540 bps; average Rx capture 58% → 71%.

- Production-animal KPIs: Milk-yield loss from subclinical mastitis −22%; vaccine adherence +35%.

- Clinical quality: Empirical antibiotic starts −26%; culture-guided therapy +19%; re-visit within 14 days −14%.

- Digital utilization: Tele-vet follow-ups account for 24% of post-diagnosis visits; no-show rate −18%.

-

Customer economics: ARPU +17%; churn −9%.

Financial Impact

- Capex (POC analyzers, LIMS, training): USD 2.1M.

- Payback: 14 months.

- EBITDA margin uplift: +260 bps network-wide; pharmacy gross margin dollars +23%.

- Incremental annualized revenue: USD 9.4M; ROI at Month 18: >300%.

Why it Mapped to Market Dynamics

- Fastest APAC growth captured via decentralized diagnostics and tele-care.

- Hospital/clinic pharmacies reinforced as leading distribution channel.

- Reference labs remained scale hubs for complex testing while POC unlocked same-visit treatment decisions.

- Companion-animal humanization monetized through wellness bundles; production-animal programs improved yield and biosecurity.

Replication Playbook

- Start with 10–15 clinics; prioritize sites with >30 daily consults.

- Bundle 3 core POC panels per species; standardize e-Rx to in-clinic pharmacy.

- Track four KPIs weekly: POC TAT, wellness attachment, Rx capture, antibiotic stewardship compliance.

- Reinvest first six months’ pharmacy uplift into staff incentives and owner education.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1621

Why North America Dominates the Animal Healthcare Market?

North America dominated the market in 2024. The high percentage of households that own pets and the presence of advanced veterinary infrastructure help the market growth. The strong government support for animal health & welfare and the availability of tele-veterinary services increase demand for animal products & services.

The growing consumption of dairy & meat products and the high prevalence of animal diseases drive the overall growth of the market. The growing trend of pet humanization and advancements in diagnostic and digital technologies are solidifying the regional growth.

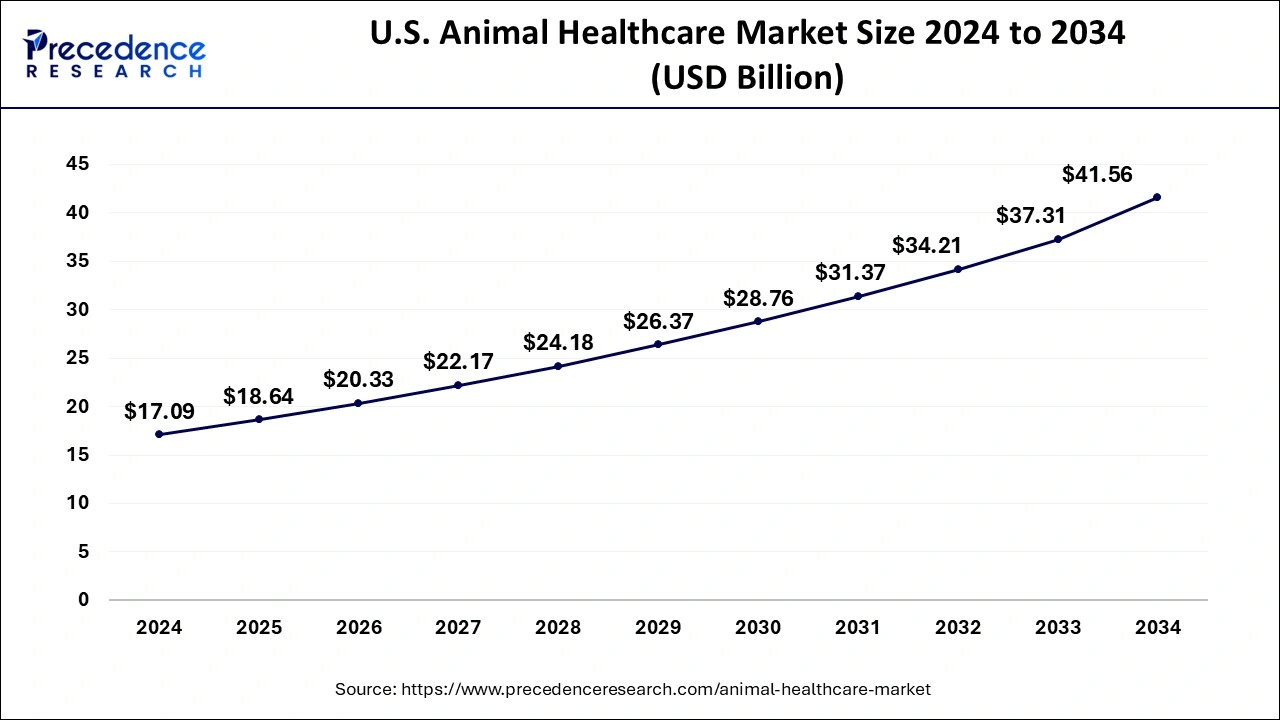

What is the U.S. Animal Healthcare Market Size?

According to Precedence Research, the U.S. animal healthcare market size is predicted to rise from USD 18.64 billion in 2025 to approximately USD 41.56 billion by 2034, with an expected CAGR of 9.29% from 2025 to 2034.

Well-established Veterinary Infrastructure Fueling the U.S. Market

The U.S. dominates the regional market due to its highly developed veterinary infrastructure, substantial investment in pet care, and strong presence of major pharmaceutical and biotechnology companies.

The country's high pet ownership rates, growing demand for animal-derived food products, and increased awareness of animal health have driven both the companion and livestock animal healthcare sectors. Additionally, favorable government policies, advanced research and development capabilities, and access to innovative veterinary diagnostics and therapeutics further reinforce the US's leading position in the region.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1621

How the Asia Pacific is Experiencing the Fastest Growth in the Animal Healthcare Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing pet ownership and focus on humanization of pets increases demand for veterinary care & services. The growing demand for animal protein and focus on the management of infectious diseases in animals increase the adoption of animal healthcare.

The growing demand for companion & livestock animals and increasing awareness about animal health support the overall market growth. The expanding livestock and companion animal sector are the fueling this growth.

Large Livestock Population: To Boost Indian Market

India dominates the regional market due to its large livestock population, growing demand for animal protein, and expanding veterinary pharmaceutical industry. As one of the world's leading producers of milk, poultry, and meat, India has a high need for animal health products to maintain productivity and prevent disease outbreaks.

The government's increasing focus on livestock health through initiatives like the National Animal Disease Control Program (NADCP), along with rising awareness among farmers about animal welfare and disease management, has significantly boosted market growth.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Animal Healthcare Market Segmentation Insights:

Animal Type Insights

Why the Production Animal Segment Dominates the Animal Healthcare Market?

The production animal segment dominated the market in 2024. The growing population of animals like swine, poultry, and cattle increases demand for animal healthcare. The high prevalence of zoonotic diseases in production animals and the focus on antimicrobial resistance in animals require animal healthcare services. The high consumption of eggs, protein, & milk, and strong government support for the production of animals, drives the overall growth of the market.

The companion animal segment is experiencing the fastest growth in the market during the forecast period. The rise in ownership of pets and the focus on the development of the human-animal bond increase the adoption of companion animals. The rise in pet insurance and increasing awareness about preventive care in companion animals support the overall market growth.

Product Insights

How did the Pharmaceutical Segment hold the Largest Share in the Animal Healthcare Market?

The pharmaceutical segment held the largest revenue share in the market in 2024. The innovations in veterinary medicine and the high prevalence of chronic & zoonotic diseases increase the adoption of pharmaceuticals. The strong focus on high-quality veterinary care and the rise in ownership of pets require pharmaceuticals. The focus on the treatment of farm animals & pet animals' conditions increases adoption of pharmaceuticals, drives the overall market growth.

The veterinary diagnostics segment is the fastest-growing in the market during the forecast period. The growing ownership of companion animals and focus on humanization of pets increases the adoption of veterinary diagnostics. The increasing awareness about early detection of diseases in livestock & companion animals and the spread of infectious diseases in livestock requires veterinary diagnostics, supporting the overall market growth.

Distribution Channel Insights

Why Hospital or Clinic Pharmacy Segment Dominating the Animal Healthcare Market?

The hospital/clinic pharmacy segment dominated the market in 2024. The strong focus on veterinary care and the growing early diagnosis of diseases in animals increases the adoption of hospital/clinic pharmacy. The presence of vaccines & pharmaceuticals in hospitals & clinics helps the market growth. The growing demand for specialized veterinary care and the high volume of animal procedures drive the overall market growth.

The retail pharmacies segment is experiencing the fastest growth in the market during the forecast period. The growing ownership of pets and focus on pet humanization increases demand for retail pharmacies. The increasing awareness about preventive care in animals and the need for OTC products increases demand for retail pharmacies. The rise in veterinary medicine and growth in e-commerce platforms support the overall market growth.

End Use Insights

Which End-Use Segment Held the Largest Share in the Animal Healthcare Market?

The veterinary reference segment held the largest revenue share in the market in 2024. The growing demand for advanced tests like toxicology, molecular diagnostics, & immunodiagnostics helps the market growth. The high-volume capacity and need for specialized consultation require veterinary reference. The focus on preventive healthcare in livestock and companion animals increases adoption of veterinary reference, driving the overall market growth.

The point-of-care or in-house testing segment is the fastest-growing in the market during the forecast period. The increasing ownership of pets and focus on instant diagnosis of diseases increases the adoption of in-house testing. The high prevalence of chronic & zoonotic diseases and the need for accessible diagnostics require point-of-care. The rise in pet ownership and increasing awareness about pet health support the overall market growth.

Treatments Insights

Why Allergies Segment Dominates the Animal Healthcare Market?

The allergies segment dominated the market in 2024. The growing allergies in animals like cats and dogs increases the adoption of animal healthcare. The high prevalence of allergic skin diseases in companion animals and growth in allergens like mold, pollen, & dust increases adoption of animal healthcare, driving the overall market growth.

The gastrointestinal (GI) diseases segment is experiencing the fastest growth in the market during the forecast period. The high prevalence of GI in dogs and increased consumption of animal protein increase demand for animal healthcare. The increasing prevalence of intestinal disorders in livestock helps the market growth. The rise in issues like obesity, parasitic infections, & inflammatory bowel diseases in pets supports the overall market growth.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Top Companies in the Animal Healthcare Market & Their Offering

-

Elanco: expanding its offerings by acquiring other animal health companies, such as Kindred Biosciences and Bayer Animal Health's business, to bolster its portfolio in both companion and food animal markets.

-

Bayer: is no longer focused on animal health, having exited the business to concentrate on its core life science segments of pharmaceuticals, consumer health, and crop science.

-

Dechra Pharmaceuticals: has grown its offerings by specializing in underserved veterinary therapeutic areas like endocrinology, dermatology, and critical care, largely through strategic international acquisitions.

-

Neogen: is expanding its animal safety and genomics offerings through acquisitions, such as 3M's food-safety business, to provide advanced diagnostic and monitoring solutions.

-

Boehringer Ingelheim: is expanding its offerings through strategic partnerships and R&D focused on first-in-class innovation for animal disease prediction, prevention, and treatment.

-

Merck & Co, Inc. (Merck Animal Health): expands its offerings through extensive R&D investment and a suite of connected technology solutions for identification, traceability, and health management.

-

Zoetis: is strengthening its offerings by investing heavily in R&D and expanding its global capability centers to develop innovative digital and AI-driven solutions for animal health.

-

Nutreco N.V.: expands its product lines, such as Trouw Nutrition (animal feed) and Skretting (aquafeed), by providing nutritional advice and advanced technology to improve sustainable food production.

-

Virbac: focuses on offering a comprehensive range of veterinary pharmaceuticals and diagnostics by continually investing in R&D and supporting both B2B and B2C channels through global e-commerce expansion.

-

Vetoquinol S.A.: is expanding its presence by providing a wide range of veterinary drugs and non-medicinal products for companion and production animals, along with new digital applications and services.

Recent Developments:

- In March 2025, Privo Technologies Inc. launched a new subsidiary, BeneVet Oncology, for advancing companion animal health. The subsidiary supports cutting-edge drug delivery systems and revolutionizes the treatment of diseases in pets. (Source: https://www.prnewswire.com)

- In May 2025, Minister N. S. Boseraju launched the cutting-edge veterinary platform, Petologists for pet parents, clinics, & farms. The app includes features like vaccination tracking, farm animal monitoring, digital health records, telemedicine consultations, & medication reminders. (Source: https://www.business-standard.com)

- In February 2024, Tata Trusts launched India’s first animal hospital in Mumbai. The facility is present across 98000 Sq Ft with a capacity of over 200 beds. (Source: https://www.expresshealthcare.in)

Segments Covered in the Report

By Animal Type

- Production Animal

- Poultry

- Swine

- Cattle

- Fish

- Others

- Companion Animal

- Dogs

- Cats

- Horses

- Others

By Product

- Vaccines

- Live Attenuated Vaccines

- DNA Vaccines

- Recombinant Vaccines

- Inactivated Vaccines

- Others

- Pharmaceuticals

- Parasiticides

- Anti-infective

- Anti-inflammatory

- Analgesics

- Others

- Feed Additives

- Diagnostics

- Instruments

- Consumables

- Equipment and Disposables

- Critical Care Consumables

- Anesthesia Equipment

- Fluid Management Equipment

- Temperature Management Equipment

- Rescue & Resuscitation Equipment

- Research Equipment

- Patient Monitoring Equipment

- Others

- Veterinary Telehealth

- Veterinary Software

- Livestock Monitoring

By Distribution Channel

- Retail Pharmacy

- E-commerce

- Hospital Pharmacy

By End Use

- Reference Laboratories

- Point of care testing/ in-house testing

- Veterinary Hospitals & Clinics

- Others

By Treatments

- Allergies

- Arthritis

- Difficult Dermatology Cases

- Gastrointestinal Disease

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1621

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Companion Animal Health Market: Explore how rising pet humanization and preventive care trends are transforming veterinary health solutions

➡️ Veterinary API Market: Examine how API innovations are enhancing drug quality and efficacy in animal healthcare

➡️ Pet Care Market: See how premiumization, digital retail, and wellness trends are redefining global pet ownership

➡️ Veterinary Antibiotics Market: Understand evolving regulations and alternatives shaping antimicrobial use in livestock and pets

➡️ Animal Genetics Market: Analyze how genetic advancements are driving productivity, breeding efficiency, and disease resistance

➡️ Veterinary Point-of-Care Diagnostics Market: Discover how rapid testing and portable technologies are revolutionizing animal diagnostics

➡️ Animal Vaccine Market: Track innovation in vaccine platforms improving livestock immunity and zoonotic disease control

➡️ Albendazole Veterinary Market: Explore demand growth for antiparasitic treatments amid expanding livestock and companion animal populations

➡️ Livestock Animal Rehabilitation Services Market: Learn how physiotherapy and rehabilitation solutions are enhancing animal recovery and welfare

➡️ Veterinary Parasiticides Market: Examine how preventive parasite control is driving innovation across companion and farm animal care

➡️ Veterinary Imaging Market: Gain insight into the growing adoption of digital imaging and AI in advanced veterinary diagnostics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.