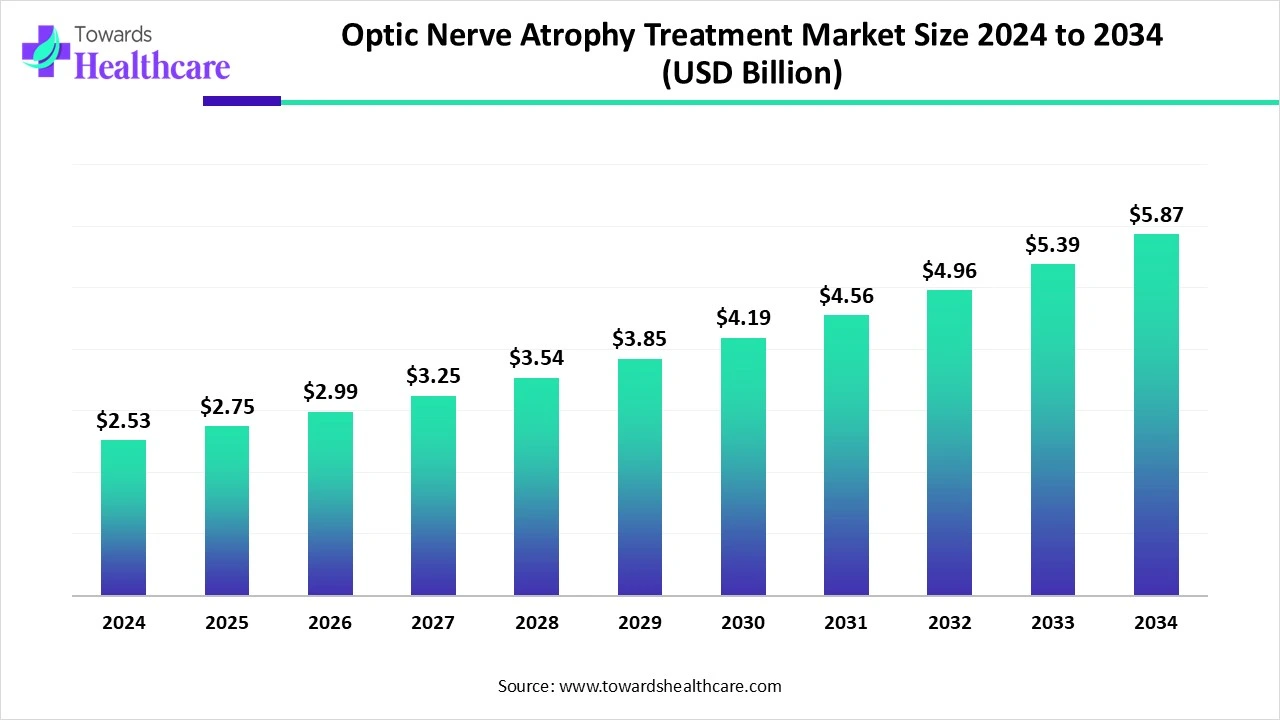

Optic Nerve Atrophy Treatment Market Forecast: USD 2.75 Billion in 2025 to USD 5.87 Billion by 2034 at 8.85% CAGR

The global optic nerve atrophy treatment market size was valued at USD 2.53 billion in 2024 and is predicted to hit around USD 5.87 billion by 2034, rising at a 8.85% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 09, 2025 (GLOBE NEWSWIRE) -- The global optic nerve atrophy treatment market size is calculated at USD 2.75 billion in 2025 and is expected to reach around USD 5.87 billion by 2034, growing at a CAGR of 8.85% for the forecasted period.

This market is rising because breakthroughs in gene-therapy, neuroprotective agents, and regenerative medicine strategies are opening previously unattainable treatment pathways, accelerating demand in the optic nerve atrophy treatment space.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5828

Key Takeaways:

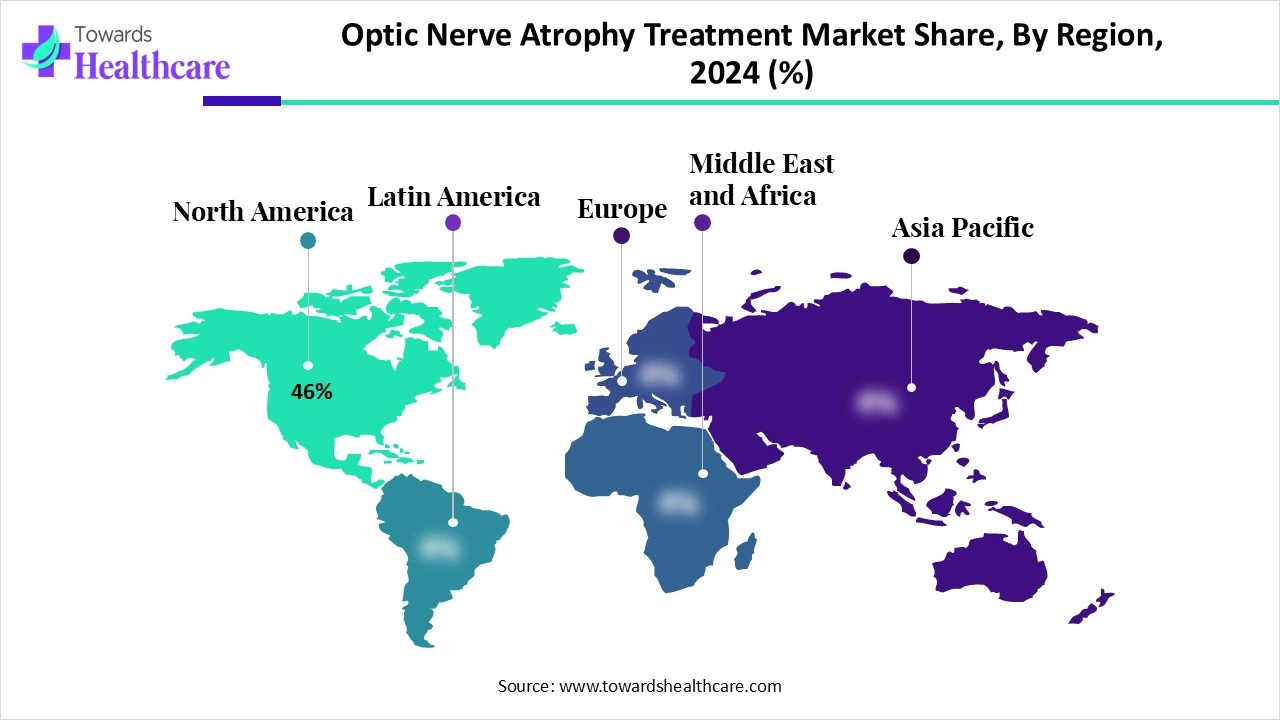

- North America is dominant in the optic nerve atrophy treatment market in 2024 with a 46% share.

- Europe is estimated to grow at the fastest CAGR from 2025 to 2035.

- By therapy type, the supportive and symptomatic therapy segment for the largest market revenue in 2024, with a 61% share.

- By therapy type, the gene therapy segment is estimated to fastest-growing over the forecast period, 2025 to 2035.

- By disease type, the glaucomatous optic neuropathy segment is dominant in the market in 2024 with a 43% share.

- By disease type, the hereditary peripheral neuropathies segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

- By drug type, the neuroprotective agents segment is dominant in the market in 2024.

- By drug type, the investigational gene therapies segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

- By route of administration, the oral segment is dominant in the optic nerve atrophy treatment market in 2024.

- By route of administration, the intravitreal segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

- By end user, the hospitals & eye care clinics segment is dominant in the market in 2024, with a 54% share.

- By end user, the academic & research institutions segment is expected to register the fastest growth over the forecast period, 2025 to 2035.

Market Overview:

What is the current state and growth of the optic nerve atrophy treatment market globally?

The global optic nerve atrophy (or optic atrophy treatment) market is experiencing strong growth, representing a compound annual growth rate in the mid-single digits. The growth is driven by rising rates of optic neuropathies (such as glaucoma and hereditary optic neuropathies), an increase in the number of diagnostic modalities, greater awareness of preventing vision loss, and an increase in R and D and investment in new therapies. Challenges remain scientific and regulatory, but the market is rapidly advancing in the face of increasing unmet needs for effective treatment and regenerative therapies.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What major components are driving the expansion of the optic nerve atrophy treatment industry?

- Increasing incidence and diagnosis of optic neuropathies: The rising average age of populations and risk factors such as hypertension, diabetes, and glaucoma are contributing to a greater number of patients diagnosed with optic nerve degeneration and, consequently, the demand for therapy.

- Advances in gene therapy and regenerative science: Innovative gene-based interventions to promote retinal ganglion cell (RGC) survival, axonal regeneration and gene editing (e.g., CRISPR, AAV-mediated delivery) are progressing from preclinical studies to clinical trials (stage 1 or 2) and are distracting funding and commercial interest.

- Strong support for research and funding: Government agencies, academic centers, and private biotechnology firms are allocating funding to optic nerve regeneration, along with peer reviewed research on identifying molecular neuro-regeneration targets, vector delivery and modulation of microenvironmental signalling factors.

- Unmet therapeutic need and demand from patients: There are currently few therapeutic options for reversing optic atrophy. Current real-world therapies provide only symptomatic or supportive care and slow the rate of disease progression, creating a great need and demand for these novel treatments.

- Regulatory encouragement and orphan drug incentives: Because many optic nerve atrophies are considered rare or hereditary, regulatory pathways (e.g., orphan drug designation, expedited review) are being introduced to encourage investment into new treatments.

Key Drifts:

What developing trends or "drifts" are directing the direction of the field?

- The integration of multi-gene combinatorial therapies to enhance optic nerve regeneration, rather than simply using mono-therapeutic gene modulation strategies.

- The use of epigenetic reprogramming and chromatin modulation to "reawaken" growth promoting gene circuits in mature retinal neurons.

- A growing focus on non-invasive routes of delivery (for example, intravitreal injections, peptides) to reduce the burden of surgery while retaining the clinical impact.

- Shared models of collaboration between biotech companies, academic laboratories, and ophthalmic centers to fasttrack translation and trial enrolment.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

There are considerable obstacles on the path to effective optic nerve atrophy treatments. Safely providing long-lasting gene therapy to the retina/optic nerve without off-target side effects or immune-mediated clearance is technically challenging, long-distance regeneration of axons with correct synaptic connectivity (beyond the optic chiasm) has not been demonstrated in animal model systems, the high costs and risk associated with transitioning to the human patient population can add to the pace of clinical translation, and with respect to the different approaches to treatment in diverse clinical variations and the heterogeneity in disease mechanisms (e.g. glaucoma, hereditary, inflammatory) makes trial designs even more challenging.

Regional Analysis:

North America represents a considerable portion of the optic nerve atrophy treatment marketplace, primarily because of its sophisticated healthcare system, future-oriented investment in research and development, and established centers of vision-related and neurological research. In the U.S., premium institutions are at the forefront of running sponsored clinical trials assessing new gene innovations and regenerative therapies.

The region also has payer policies that encourage access to new therapies for rare diseases, and (in some instances) provide incentives for new medications, where applicable, to demonstrate benefit for patients with rare diseases. Many biotech and pharmaceutical companies developing potential treatments for optic nerve and other ocular conditions are also based in North America, leading to quick and relatively localized advancements.

Europe is anticipated to be a region with the fastest expansion in the optic nerve atrophy treatment market, based on increased government support for innovation related to rare disease, increase in research consortia across multiple nations, and increased funding supporting neuro-ophthalmology. Countries such as Germany, the UK, France and Switzerland are developing gene therapy infrastructure and regulatory pathways for more advanced therapeutics. European Union policies for harmonization, as well as establishment of regulatory agencies which allows for centralized review for drug and biologics approvals have broadened multi-national clinical trials and applications. The increased burden of ocular diseases, increase in aging population and increased access to complex diagnostics also allow for a faster uptake of drugs in the marketplace. European biotech as well companies have been partnering with academic centers/consortiums to develop manufacturing and trials locally, which will allow for a faster uptick in early-phase trials and commercialization.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By Therapy Type:

The supportive & symptomatic therapy category took the highest revenue share, as these methods are currently the first line of treatment. Due to the limited available therapies, clinicians, and patients often resort to neuroprotective agents, antioxidants, ocular blood flow enhancers and visual rehabilitation, to manage the clinical symptoms of the disease and to slow further damage. These treatments typically incur less regulatory burden and have less risk for development (foster more rapid commercialization) versus gene therapy.

The gene therapy segment will be the fastest-growing due to the promised potential to modify disease rather than just relieve symptoms. Developments in gene editing, such as CRISPR and base editing, vector design, and retinal targeting for delivery, will help lower barriers to clinical translation. As proof-of-concept examples are found, and regulatory frameworks change to accommodate these therapies, gene therapy will supplant supportive therapies for appropriate subsets of patients.

By Disease Type:

Glaucomatous optic neuropathy is estimated to hold the most significant share of the market in 2024, at approximately 43%, because glaucoma is one of the most common causes of optic nerve damage throughout the world. Elevated intraocular pressure, vascular dysregulation, and oxidative stress in glaucoma patients leads to a large population of patients seeking neuroprotective and neuroregenerative therapies. The established clinical practice and clinical diagnostic pathways of glaucoma create the theoretical ability to engage a pre-existing cohort of patients into the market.

Hereditary optic neuropathies (e.g., Leber's Hereditary Optic Neuropathy, dominant optic atrophy) & related peripheral neuropathies have the highest anticipated growth. These diseases represent a strong candidate for a gene replacement or editing therapy as their monogenic causes are known. The advent of gene replacement or replacement technologies with an increasing number of modalities dependant strongly upon the anticipated process of gene replacement, the effects of rare diseases will be an industry driver as there is strong incentives for development for these modalities.

By Drug Type:

The neuroprotective agents segment dominated in the 2024 timeframe. Available therapies are primarily geared toward preserving surviving retinal ganglion cells and preventing further degeneration. The predominant agents are CNTF gene therapy (in animal trials), BDNF analogs, and small molecules that modulate apoptosis and oxidative stress. Given that curative therapies are all mostly still in experimental stages the current markets represent one of neuroprotection.

Over the timeframe 2025-2035, investigational gene therapies will have the highest predicted growth rate due to multiple ongoing trials (GenSight's LHON therapy has demonstrated sustained efficacy at 5 years) and the existing pipeline in the novel AAV, CRISPR, and base editing strategies. Gene therapies are increasingly coming into focus for investors and developers who are increasingly targeting these high possibility modalities who expect steep adoption curves once some safety and efficacy real world data is established. This segment will be a key growth engine for the market in the future.

By Route of Administration:

The oral segment is expected to have the highest share because most neuroprotective accomplishments and symptomatic therapies (e.g. antioxidants, small molecules, systemic neurotrophic agents) are developed for oral administration (with additional restrictions in the case of some drugs). Overall, oral delivery is associated with the greatest convenience, patient compliance, affordability, and streamlined supply chains compared with invasive systems for administration. Consequently, the overwhelming majority of approved or marketed neuroprotective treatments utilize oral formulations, providing the largest proportion in oral/prevention treatment formats.

Between 2025 and 2035, the intravitreal administration route is forecast to demonstrate the fastest growth. Intravitreal delivery directly delivers agents to the retina and optic nerve tissues; thus, minimizing systemic drug exposure. The technology for intravitreal therapies is highly complex and rapidly evolving (e.g. viral vector design (AAV), with controlled-release formulations; or even with safer intravitreal administration).

By End User:

Hospitals and eye care clinics are projected to constitute the largest share of end users in 2024. These facilities are where optic atrophy is principally diagnosed, advanced therapies (injections, gene therapies) planned and administered, patient long-term monitoring, etc. with their existing infrastructure, and access to specialists (neuro-ophthalmologists), as well as their association with research centers, provide the obvious pathways for new products to reach the market.

Academic & research institutions are projected to have the highest growth rate among end users. Academic and research institutions usually lead in first-in-human trials, developing gene therapy, and in the advancement of research in regenerative medicine. When experimental therapies advance to the clinical trial stage, academic hospitals and research eye centers will gradually begin to utilize them.

Browse More Insights of Towards Healthcare:

The global nerve conduits, wraps, protectors, cap, connectors market size was estimated at US$ 255 million in 2023 and is projected to grow to US$ 691.98 million by 2034, rising at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2034.

The global nerve repair and regeneration market size is calculated at USD 10.25 billion in 2024, grew to USD 11.5 billion in 2025, and is projected to reach around USD 32.4 billion by 2034. The market is expanding at a CAGR of 12.2% between 2024 and 2034.

The nerve conduit market was estimated at US$ 145 million in 2023 and is projected to grow to US$ 430.55 million by 2034, rising at a compound annual growth rate (CAGR) of 10.4% from 2024 to 2034.

The global artificial nerve conduits market was estimated at US$ 2.37 billion in 2023 and is projected to grow to US$ 5.79 billion by 2034, rising at a compound annual growth rate (CAGR) of 8.35% from 2024 to 2034.

The global synthetic nerve conduits market was estimated at US$ 1.57 billion in 2023 and is projected to grow to US$ 3.07 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.29% from 2024 to 2034.

The global absorbable nerve conduits market was estimated at US$ 4.55 billion in 2023 and is projected to grow to US$ 7.38 billion by 2034, rising at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2034.

The global resorbable nerve conduits market size was estimated at US$ 2.31 billion in 2023 and is projected to grow to US$ 5.28 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2034.

The global peripheral nerve conduit market was estimated at US$ 154.42 million in 2024 and is projected to grow to US$ 411.58 million by 2034, rising at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2034.

Recent Developments:

In August 2024, GenSight’s gene therapy for Leber hereditary optic neuropathy (LHON) demonstrated sustained efficacy over five years, reinforcing long-term viability of gene-based interventions.

Optic Nerve Atrophy Treatment Market Key Players List:

- GenSight Biologics

- Santhera Pharmaceuticals

- Stealth BioTherapeutics

- REGENXBIO Inc.

- Allergan (AbbVie)

- Novartis AG

- Glaukos Corporation

- Santen Pharmaceutical Co., Ltd.

- Bausch + Lomb

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Nanoscope Therapeutics

- Stealth BioTherapeutics (Elamipretide)

- Kubota Vision Inc.

- EyePoint Pharmaceuticals

- Spark Therapeutics (Roche)

- Quark Pharmaceuticals

- Neurotech Pharmaceuticals

- NEI/NIH (National Eye Institute)

Segments Covered in the Report

By Therapy Type

- Supportive and Symptomatic Therapy

- Visual aids

- Occupational therapy

- Corticosteroids

- IOP-lowering drugs in glaucomatous atrophy

- Neuroprotective Agents

- Brimonidine, Citicoline, Memantine

- Gene Therapy

- Targeting mitochondrial mutations

- AAV-mediated gene delivery

- Stem Cell Therapy

- Electrical Stimulation Therapy

- Nutritional Supplements

- Vitamin B12, Folate, CoQ10

By Disease Type

- Glaucomatous Optic Neuropathy

- Ischemic Optic Neuropathy (ION)

- Traumatic Optic Neuropathy

- Hereditary Optic Neuropathies

- Leber’s Hereditary Optic Neuropathy (LHON)

- Autosomal dominant optic atrophy (ADOA)

- Compressive and Inflammatory Atrophy

- Optic neuritis (e.g., MS-related)

By Drug Type

- Neuroprotective Agents

- Corticosteroids

- Mitochondrial Enhancers

- Investigational Gene Therapies (Fastest Growing)

- LUMEVOQ® (GS010 – GenSight Biologics)

- NR2E3, OPA1 targets

By Route of Administration

- Oral

- Intravitreal

- Intravenous

- Subretinal

By End User

- Hospitals & Eye Care Clinics

- Specialty Neuro-Ophthalmology Centers

- Research & Academic Institutions

- Homecare/Low-Vision Rehabilitation Centers

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5828

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.